Allow me to start by beating a dead horse. There is a vital difference between what may in fact be the ideal, perfect monetary system and what are the real monetary changes we are heading straight into today. My purpose for writing this blog is to share with you, and in return to receive your feedback on my own discovery and understanding of the latter. There are plenty of other sites that discuss the former.

If we can discover together where we are heading financially, economically and monetarily, and why we are heading there, then perhaps we can know, in advance, how the understanding of the global consciousness will evolve and unfold in the coming weeks, months and years. And, with this understanding, hopefully we can gain a certain peace of mind with regard to our own financial decisions, positions and future as we head into very stormy waters.

I know from my own experience that a little peace of mind is a priceless asset. It is one worth sharing, and one worth growing. Sharing and growing this asset together with you is my goal. Onward...

Our Understanding of Money

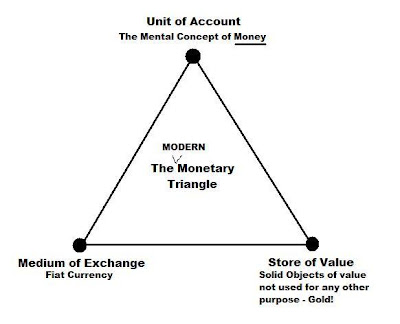

Let us quickly run through an assortment of common understandings of the term 'money'. The most common, mainstream understanding of money is that of a device bearing three functions. The three functions are 1) medium of exchange, 2) unit of account and 3) store of value.

A more purist understanding states that money is only a medium of exchange. And that the usability of money in other roles flows from its declared form. For example, if our common medium of exchange is physical gold only, then it is also an excellent store of value.

In fact, as a medium of exchange, money is only one half of a full barter exchange. The other half is when you change your money into that item you desire. But when physical gold is the common medium of exchange, then it is possible that the concept of a "medium" (or middleman) is incorrectly applied, because if gold was what you were after (for its store of value function), then the exchange is completed in only one step! Direct barter!

Finally, there is our new understanding of "the pure concept of money" which is our innate human ability to associate relative values. And within this understanding of 'money', it became clear that in order for our ability to function properly and efficiently in the way it has evolved over millennia, gold must be free for each of us to impute value to it.

Gold Exchange Standard

Our most recent experiment with gold as the conceptual medium of exchange ended badly. The purist understanding of money, the common medium of exchange, longs for it to be a real commodity, or at least linked to a commodity so that the actual medium can have a relatively stable value and double as a store of wealth. But when we lock a finite commodity into a parity relationship with an inflating paper currency, we only drag down that commodity's relative value compared to the rest of the real world as the related currency is inflated.

Over time, pressure builds up in this relationship set at par, the same as pressure builds between two business partners where one is lazy and unproductive and the other must carry the business through hard work. Sooner or later some of that pressure must be released and parity must be broken. Perhaps the lazy partner's equity position in the business is cut or reduced to reflect his lack of contribution, buying the ill fated relationship a little more time. This is what Roosevelt did with the dollar/gold relationship in 1933. But eventually these mismatched partners will have to part company once and for all. Just as gold and the dollar did in 1971.

In 1971 official parity was broken, but not forgotten. In the years since, an unofficial parity of sorts has been maintained through the paper gold market. Paper gold, like dollars, can be expanded and inflated while being locked at a par with the real thing. This is still going on today. But the pressure has been building for a long time now. This pressure held in the parity relationship between paper and physical gold is about to blow.

Gold Coin Standard

Even the gold coin standard we had leading up to the creation of the Federal Reserve System ended badly. You see, people put their gold coins into the banks and the banks lent them out. And then when confidence suffered a shock and the banks faced a run on gold, the system collapsed, many banks failed, and people lost their gold.

Human people want to be able to borrow money in the present that they plan to earn in the future. Not all people want to do this, but enough to influence the system certainly do. And this practice, by its very nature, expands the money supply beyond its physical commodity limits, even in a pure gold coin standard.

During the late nineteenth century, all the major nations of the world moved toward a gold coin standard, wherein the gold coin itself was the common currency and medium of exchange. Between 1873 and 1912 some forty nations used it. [Answers.com]

The following is a post by Randy (@ The Tower) describing the end of the gold coin standard and the dawn of the Federal Reserve System (in blue).

Continuing our investigation into the meaning/essence of "money"... In 1907 America was on the Gold standard and WITHOUT any central bank. Many modern goldbugs might be inclined to yearn for those "good ol’ days" when "money was money and banking was as it should be!"

However, that year is best known by the Panic of 1907 in which the people's economy was plagued by runs on trust companies, banking panics, and a bear market in stocks. Across the nation, banks were unable (and refused) to deliver gold coins and currency to satisfy the requests of depositors for withdrawals of money from their own accounts -- and 246 banks collapsed. It is not difficult to see how the frustration of depositors unable to obtain currency from banks (even solvent ones!) holding their deposits would lead to pressure for political intervention and change.

For a quick exercise in perspective, imagine what you would do today if faced with the same situation in which your bank could not give you any currency ($1s, $5s, $10s, $20s $50 or $100s) to carry away with you as a representation of the money residing in your bank account. No problem. You would simply write a personal check to meet your spending needs, or perhaps ask for a bank draft, or wire the money wherever it needed to go. Amazing! What IS money??? How did you get yours; where did it come from? How do you know what its value is?? Ponder that, and now we return to our glimpse at history...

In the wake of this banking panic, a National Monetary Commission was formed to undertake a scholarly look at the failings of America's financial system. Of these, the four major flaws cited were that the banks were decentralized, clearing methods were inefficient, the huge cash holdings of the federal government were not distributed where most needed, and the currency supply was inelastic. (Please ponder for a moment how or why the CURRENCY supply would ever be an issue if the amount of MONEY found in banks were at a one-to-one ratio with the currency (gold) that represented it. Surely, in this absence of a central bank there couldn't be more money than gold coin! That's impossible!!

Through the coordinated stabilizing actions of three prominent NY bankers to arrest the banking panic [J.P. Morgan, George F. Baker (First National Bank), and James Stillman (National City Bank / Citibank)], their wealth and power was perhaps made more conspicuous in the eyes of the nation than perhaps it would otherwise have been. A prominent Wall Street lawyer named Samuel Untermyer suggested that there was a "Money Trust", and The Wall Street Journal also took notice of affairs and wrote, "So long as Congress will not give us what every other civilized country possesses, a central bank, it forces Wall Street to improvise something of the kind itself."

The House Banking and Currency Committee formed an investigative subcommittee to determine whether a Money Trust existed in NY. The chief counsel was Sam Untermyer, and I think you might gain some insights about the true nature of money from the testimony delivered by Morgan and Baker before the committee in Washington DC at the beginning of 1913.

In questioning Baker about the proposal for banking reform regarding expanded disclosure of bank assets and investments, Untermyer probed, "Why should not the assets, and the detailed assets, be a matter of public knowledge?"

Baker replied, "Business would come to rather a standstill."

Untermyer demanded, "I want you to explain to the committee why."

Baker declined, "I can not explain it."

Untermyer pressed further, "You mean you can give us no reason?"

Baker admitted, "It would be exposing all the details of that business to the whole world."

After following a sidetrack in questioning, Untermyer returned to this issue, asking, "Why should the public do business on confidence when it can get the facts?"

To which Baker proclaimed, "Mr. Untermyer, THE FUNDAMENTAL PRINCIPLE OF BANKING, perhaps more than some others, is CREDIT." [emphasis added]

It seems that George Baker sensed (rightly?) that the public, familiar with their Currency being a tangible asset (gold coin), would NOT be readily comfortable with the truth about Money. That is to say, that they might struggle to accept the reality that their Money Supply, as represented on the books of the bank, was created by credit, and existed through the grace of confidence. In effect, the tangible Currency had become a mere symbol for the Money (credit) it represented while circulating outside of bank account ledgers.

If you don't care to believe my assessment, I have another point for you. When Untermyer had J.P. Morgan on the witness stand, he asked him, "Is not commercial credit based primarily upon money or property?" [In this exchange, it appears that Untermyer ignorantly used the word "money" as equivalent to gold coin, a usage which Morgan plays similarly until his concluding point about granting CREDIT.]

Morgan responded, "No, sir, the first thing is CHARACTER." [emphasis added]

Untermyer, shocked, reiterated, "Before money or property?"

Morgan reassured, "Before money or anything else. Money cannot buy it. [credit]"

Untermyer remained obstinate against this notion, as though there were communication difficulties, and pressed again on this point.

Morgan then conclusively stated his conviction on the point that commercial CREDIT is based on character: "Because a man I do not trust could not get MONEY from me on all the bonds in Christendom."

From two eminent bankers who surely knew their business, you now have it that the creation or granting of Money (the extension of Credit) has more to do with the creditworthiness of the borrowers than the collateral that secures against possible default. And recall, these comments occurred while on a gold standard AND in total absence of a government-sponsored central bank -- which was authorized (against Baker's preference) a year later.

As you come to understand how Money and Credit are interrelated, the more you will understand the separate Wealth of gold and why you need it now more than ever.

The point here is that our modern understanding of money, or any money concept for that matter, combined with our modern taste for borrowing, lending and trading of credit and debt, may not NECESSARILY be a perfect fit with a pure gold standard. Even a gold standard, with gold as the actual currency, is manipulated by the banks through confidence-based lending schemes. Sure, a gold standard somewhat limits the collective in its more nefarious pursuits, but it also has flaws that always seem to lead to the same conclusion... failure.

Perhaps it is time for us to consider another alternative, even a natural one that is happening whether we like it or not. How about a new, de facto, free market-driven stasis instead of the old de jure (rigged) false parity relationship... how about Freegold?

The Fourth Dimension: Time

At any given moment, a snapshot of our world appears to be only three dimensions; left/right, backwards/forwards, up/down. But with the passage of each and every moment, the world changes. Values change! People change. Everything changes. And all of these changes happen as we move through the fourth dimension, time.

This fourth dimension is very important as we consider the pure concept of money. For it is in this fourth dimension that our pure concept of money resides!

If time was not a factor, then anything accepted as a generic medium of exchange could perfectly perform all the functions commonly linked to the term 'money'. You do your work (somehow without the passage of time) and get paid, and then spend your money on anything within that same moment in which your work's value was judged against the entire universe of real things. A perfect stasis of values would exist everywhere, all at once.

But here in the real world we must be concerned about how far we carry our money through the fourth dimension. Without this vital consideration, we stand to lose everything!

Breaking the Triangle

In part 1 of this series I used a diagram I created called The Modern Money Triangle. The three corners of the triangle represented the three primary functions of our modern understanding of money.

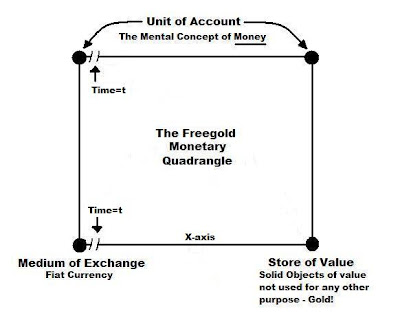

But as we pass through the coming phase transition in which the parity between paper gold and physical gold will be broken, cracks will start to form in certain parts of the triangle.

The fractures you see in this diagram are time related. On a short timeline [length of time is the key variable: "t"] fiat currencies will perform our necessary monetary functions, medium of exchange and unit of account. But at some point on the x-axis, 'length of time', we will switch to a different medium, gold.

On a long timeline, gold will perform our necessary monetary functions perfectly, store of value and long term unit of account. By the way, there is no upper limit on the x-axis of 'length of time' when it comes to gold. If plotted out it runs to infinity!

The outcome will be my new Freegold Quadrangle!

The "x-axis" represents the amount of time you are willing to hang onto the fiat currency you either earn or receive in payment. If the monetary authority is printing money, "t" will be shorter and shorter. In a hyperinflationary situation "t" will slide all the way to the left with a value close to zero. [1]

As the new Freegold system of natural, pristine balance emerges, the fiat monetary authority will find its wisest move is to keep the money supply under control. And with a "wise" CB, gradually the "t" value will shift back to the right, little by little.

The further "t" moves to the right, meaning the longer people are willing to hang on to their fiat, the more investment will flow into new businesses in that currency zone, and the more tax the greedy collective can grab. This is how it will work.

But even MORE interesting to us physical gold advocates is how we will get there!

In part 2 of this series I explained that "they" will save the system at any cost. And that this stance presented them with a dilemma. You see, if they don't save the system then "all paper will burn" and gold will "shoot the moon" as the wealth reserve par excellence. But if they DO save the system, "the cost" will be the devaluation of the dollar along with all fiat currencies... and gold will "shoot the moon" as the wealth reserve par excellence.

Q.E.D. [quod erat demonstrandum].

The Catch-22 of Modern Paper Wealth

The phrase "Catch-22" is common idiomatic usage meaning "a no-win situation" or "a double bind" of any type. [Wikipedia] "The catch" in our modern concept of paper wealth is that on one side it is collapsing from its own unsustainable debt service making it, in fact, a non-wealth. But on the other side, if we rescue it from its own un sustainability by guaranteeing or propping up the debt service, we collapse the very denominator of the wealth itself, the currency, and make it a non-wealth. It is a lose-lose situation... a Catch-22!

Do you remember the 1985 movie Wall Street? In it Gordon Gekko liked to buy whole companies through the stock market, shut them down, break them up, and then sell off the pieces. He had figured out that the pieces were more valuable than the whole. Remember in the end of the movie he went after Blue Star Airlines? My, how things have changed in 24 years.

On Friday we learned that Japan Airlines is now completely worthless. Its net worth is now NEGATIVE $8.8 billion!

JAL faces $8.8 billion excess debt if liquidated: source

TOKYO (Reuters) - Liabilities at Japan Airlines Corp (Tokyo:9205.T - News) would exceed its assets by as much as $8.8 billion if Asia's largest airline by revenues were liquidated, a source with direct knowledge of the matter said on Friday.

The estimate of JAL's negative net worth, calculated by a government-led task force in charge of its restructuring, underscores the depth of the problems facing the airline as it seeks aid from banks and the state to avoid bankruptcy.

Did you know that on Friday people were still buying JAL at a market capitalization price of $3.4 billion even though it was worth [NEGATIVE] -$8.8 billion? One thing I know for sure; Gordon Gekko would NOT have been interested in this one.

Which begs the question, how is the rest of the (publicly traded) economy doing after 24 years of debt accumulation?

This is where the $-debt regime has left us. With empty, hollow shells of corporate entities enslaved to produce revenue only to service their unsustainable debt. What if the owners of JAL decide to leave their vacuous corporate shell behind like a hermit crab abandoning his home, for the greener pastures of a fresh start? That debt hole, the $8.8 billion, is what we hold today as wealth!... inside the financial system! It is gone, not there, if they walk away. Just like an underwater homeowner walking away from his home. If the debt-slave quits, the value illusion is gone!

The entire financial industry today is marked to model, myth, illusion, whatever... just not reality. It is amazing that we even got a story like this, exposing a small portion of the gap between reality and "high finance". JAL is a dead man walking.

At least we are getting some honesty with regard to the real value of JAL. How about the rest of them? How about the banks? Who's debt do YOU hold as wealth? How is THEIR balance sheet doing? Do you have any idea?

Gold is pure equity... no one's debt. No one to walk away. No one to default in bankruptcy. Nothing to liquidate in an attempt to recapture 10 cents on the dollar.

The entire US banking system today is built upon the idea that debt-slaves will continue servicing their debt on millions of underwater houses marked to mythical values at which the loans were established. If you hold your wealth within this freakish system... all I can say is good luck!

The knowledge of the difference between principle and interest must be dead. Everyone is chasing an imaginary yield from entities with negative equity today... with their hard earned principle savings. Can you believe it?

But don't worry about JAL. It won't be quitting. It has been deemed too big to fail! This means that the printing press will guarantee not only its debt-slave service, but its executive bonuses as well (to keep the slaves in the field)!

Next up, the idiotic concept of too big to fail is set to bring down all the imaginary currencies, and with them, the system itself. And once again, gold is not only immune but highly levered in the OPPOSITE direction.

Consider this: You may not fully understand where we are heading. You may be figuring it out at your own pace. But the millions of ungodly fortunes in the world (yes, there are millions of fortunes) don't have that luxury. They must figure it out FAST... or die.

Survival of the Fittest

Try to imagine each and every fortune that exists today as a distinct animal. These "fortunes" can be held by individuals, organizations, by funds, or even by sovereign collectives. They can also be held in any number of vessels at this current time. For instance, the Saudis' fortune is largely held underground in oil deposits. Other fortunes are in paper financial products, like your pension fund, and others are already in gold.

As we move forward, the law of nature, the survival of the fittest will come more and more to the forefront. The wholesale creation of new digits is one way that some of the more inbred fortunes are trying to survive. Will it work? Others, with a deeper gene pool, are fleeing to the safety of gold.

Imagine this world of TOO MANY "fortunes" vying for survival in the limited landscape of the real world which is actually too small for them all to survive. The fortunes that have moved entirely into physical gold have already staked out their claim to a specific volume of real estate that is needed to survive in this brutal world. They now own their own territory, a true slice of the real world pie, on which to live and thrive.

Those that are still trying to increase their claim size by inflating paper digits may miss out because the landscape of reality is quickly being bought up by the more clever and observant animals. Survival of the fittest! Those fortunes that make the right moves in these trying times will be the ones to survive and thrive. The rest will die.

These "fortunes" are the giants. Their titanic battle for survival in the limited real world is what will take us where we are going. They need to figure things out quickly if they want to survive. Natural selection will pick the winners and kill off the losers. Today this epic battle nears its climax.

Stake out your own claim today before this final act unfolds. Then spread the word to as many people as possible. This is the best we can do, Lilliputians that we are.

Sincerely,

FOFOA

[1] No, the y-axis is nothing but a perpendicular connecting line to a parallel function. I am making a point with the help of visual aids and common understanding. I am not making a mathematical proof. Sorry if I offended any mathematicians with my terminology. :)

104 comments:

"The wholesale creation of new digits is one way that some of the more inbred fortunes are trying to survive."

Vampire Squid and Da FED are going to hate you for this one;-)

Hello Fofoa,

Great great articles. I appreciate your work in enlightening us all.

I read this from Karl Denninger yesterday and almost fell from my seat. So he now changed idea and thinks the dollar will rise:

http://market-ticker.org/archives/1539-Possible-Credit-Dislocation-Be-Warned.html

"If you want to speculate on this outcome levered bets on radical dollar appreciation look like one of the best choices out there"

"Disclosure: Initiated a small speculative, defined-risk play LONG the US Dollar"

How can this be? I dont get it and kindly ask for this community's help to understand this. What in the world made him change, and does it make sense?

Thankyou

You guys might want to read this as well.

Gold's rise is largely financed by the dollar carry trade. Gold is rising on borrowed money that is.

Borrowed dollars, and the futures market.

"Thing is," as a professional wholesale dealer here in London's bullion market told me today, "the ETFs still don't show any signs of shrinking when the price takes a dip. They're as sticky as ever. But no, overall, physical flows at the moment are nowhere as strong as they were. The action's very much in the futures."

Here's what I don't understand: if you peg the USD to gold, then the only way to expand the monetary supply is to buy more gold. Population growth alone should dictate that either the monetary supply should expand, or that deflation should occur, given there's the same amount of currency in circulation for more people. Or one could adjust the peg, but this is also deflationary or at least introduces a sudden shock into the market.

I am having a hard time understanding how a gold-backed currency could work out in the long run.

Anonymous at 6:05,

Not sure if this is in line with your query, but check out FOFOA's short discussion of deflation and a gold standard here - http://tinyurl.com/m2x7rd

Imagine a hypothetical perfect gold standard. There is nothing but gold used as money, and its supply remains constant. As man labors and builds, the economy will grow, and gradually one piece of gold will equal more and more real goods and services. Over time, in this perfect gold standard, the value of that piece of gold will rise and the cost of goods and services will fall.

Now imagine a lender and borrower. The lender lends 10 ounces of gold to the borrower, who then trades it on the open market for the goods he needs to be productive, say, farm equipment.

Let's say the term is a 5 year loan and there is no interest in this perfect world. After 5 years, the borrower must return the 10 ounces of gold that he borrowed.

During those 5 years, the value of gold will rise and prices of goods will fall, what we currently think of as "deflation". So in 5 years when the farmer must reacquire gold on the open market, he will have to surrender more goods than he received for that same gold 5 years earlier. Likewise, the lender will receive his gold back with greater purchasing power than it had 5 years earlier.

In essence, the lender received "interest" and the borrower paid "interest", even though the money supply remained the same. All that changed was the economy against which the money is measured! The interest was the productivity that the borrower added to the economy. The lender profited from this economic growth and the borrower labored to meet his obligation.

So in this perfect world, the price of borrowing money means keeping up with the average productivity of everyone else in a growing economy.

In other words, money is priced in goods and labor. The price of money is goods or labor. You must either create them or surrender them for money.

Hi Martijn,

It seems that article suggests that use of leverage/easy money to purchase gold futures and drive up the gold price might not represent a sustainable move, and thus another asset deflationary shock might cause these firms to liquidate their leveraged positions to meet capital calls, thus collapsing the price of gold (at least the price of paper gold).

Is there a different angle than this to take from that article, or a better way to view this phenomena?

Thanks

@Alex

The dollar is the carrytrade. Indicators also show that the dollar is drastically oversold. That means that basically the whole market is speculating on a drastic slide in the dollar. Generally that is a rather good indicator that the market will turn in order to meet its average. No guarantees, but we might see a short squeeze in the dollar soon, that is basically what he is saying.

The same shortage of dollar liquidity (cash dollars) occurred when Lehman collapsed.

A shortsqueeze in the dollar would mean that everyone starts selling (paper) assets in order to obtain the dollar. Hence stocks, CDOs and everything will fall and the dollar will rise.

As this would trigger massive panic, it is unclear what gold would do. As most gold owners are in the game to protect their wealth they might hang on to their gold, and gold may rise.

However, lately some speculative money has been using dollar lending to buy gold. They might be forced to liquidate, which would be less good for the gold price.

I am not guaranteeing the above, but I do believe it is the scenario Denninger is talking about.

@Anon: I am having a hard time understanding how a gold-backed currency could work out in the long run.

No one here is arguing for a gold-backed currency.

@Anon

It seems that article suggests that use of leverage/easy money to purchase gold futures and drive up the gold price might not represent a sustainable move, and thus another asset deflationary shock might cause these firms to liquidate their leveraged positions to meet capital calls, thus collapsing the price of gold (at least the price of paper gold).

I believe that is what the article says.

However, a next deflationary shock - caused by increased dollar desire and massive asset sell-offs to feed that hunger - will also trigger a panic. That might drive cash money to physical gold.

So perhaps such a scenario might drive people out of the paper gold market and into the physical one. As gold prices are currently set on the paper markets gold in dollars might decline, although I wouldn't bet on that as we might really see panic bigger than the Lehman collapse.

Off course all this is just speculation on a possible scenario.

I am having a hard time understanding how a gold-backed currency could work out in the long run.

It really can't and the smart ones are not advocating that we return to a gold standard. A gold standard also opens up a country to foreign manipulation.

Gold to replace dollar as reserve currency?

This has been a wonderful series of articles. Thanks so much for the time you've spent on them.

Oh, and "Allen" I don't know how you can say that our current standard doesn't open us up to foreign manipulation. There's going to be manipulation no matter what the standard is. Right now China has a huge roll of dollars and that is manipulating the markets and policy. They are also bulking up on gold too, for what kind of manipulation I don't fully know.

But manipulation is part of any market.

I think the desire for a gold back currency is that there is a recognition that currency should be based on something tangible. Fiat currencies are based on something that is terribly hard to quantify and often feels like so much smoke and mirrors.

I think gold will stay relatively flat against the dollar (plus or minus 10 percent) when the next big stock market drop comes. The number of people who have figured it out, and run to gold will be balanced out by those who haven't, and run to the dollar. After that, once the public sees gold as one of the few things holding strong, the real run will begin. Assuming the drop comes fairly soon. The longer it takes the less likely gold will fall at all as dollar confidence slowly grinds down.

FOFOA; As an animal lover, I find the metaphor of your first sentence jarring and offensive. Would you agree to using the formulation "flogging a dead bankster" instead? Far more satisfying, methinks.

You have now made the case for sound money resoundingly. Those who profess confusion at this late hour are beyond help. Many questioners would do well to spend a few hours perusing your archives.

Could you give an outline of how the transition from $$ and other fiats will progress? Obviously non-linear, but what is your best model hypothesis for how this will actually unfold? Thanks FOFOA.

Buster

I understand how backing dollars to gold helps try to keep inflation in check, but going back to a gold standard is NOT the answer. For more in detail on this, you can read the book "The Lost Science of Money". The answer to the problem is to take money creation powers away from private banking. End or Nationalize the FED and prohibit fractional reserve banking.

Think about it. The FED trying to control the money supply by adjusting interest rates is like driving a car from the back seat. Fiat money creation should be a matter of "Law".

How is money currently created???? Money is created by being loaned into existence by private banks. The money supply is this country is controlled by private BANKS! And the biggest of the bunch is the Federal Reserve which is also a PRIVATE BANK. Now, one can ask who should control the supply of money - private or public entities? Why isn’t our money supply controlled by the government? The reason is that our constitution (and founding fathers) really didn’t address the MONEY power and because of this, the money power was and still is controlled by powerful, private banks. Is this a good idea? Is this a stable environment? I believe both of the questions have been answered, but to provide some more doubt, let’s compare money creation with the military. Let’s say the military was setup in a similar fashion where thousands of private armies (like banks) all competed for revenue and profit. Could you image the chaos? Would this ever work? How is it then, something as vital (money) as national security, be controlled by private entities?

raptor:

FOFOA, you should clearly mention somewhere that your blog is not about the return of the gold-backed currency.

And explain shortly what is the difference between freeGold and gold-standard.

So that there is no confusion when somebody visit your blog for the first time. Especially when the article says "Gold is money", ppl immediately associate this with gold-standard ;)

keep the articles coming ;)

I try to believe; I really do. I've even acted on some of the advice here and elsewhere and bought some gold. However, I just can't go all in, as they say, inasmuch as it appears to me to require a leap of faith. The future is unknowable. If we do experience deflation and/or a hyperinflationary fiat currency event, who knows what the elites will attempt. I hope what FOFOA posits will be the ultimate outcome, but it seems to me less than a lock. Therefore, while I have hedged a little in favor of a rising gold price, I still feel too much like Mulder.

Hello Alex Berre,

Re: Denninger's Credit dislocation

This crisis is, and always has been, a systemic crisis, meaning the entire system is unstable and could catastrophically collapse at any time. If the signs that Karl is seeing are real, then they pose a serious threat to the entire financial system, not just a dollar rally and no available credit. Karl says the Fed is aware this is a solvency problem. This means there are a whole bunch of Japan Airlines out there, especially on Wall Street!

Remember from my post that there is short term money, and long term money "storage". Short term money is operational money. It is the money companies need for daily operation and debtors (and banks) need for their debt service. This is the stream of funds that will disappear in a credit market dislocation like Karl sees.

The result will be the failure of the paper wealth that is based on the debt-slaves that will be cut off from their stream of credit. The yield stream will vanish and savers will look to their principle and find that it is gone too. This will cause a flight of capital out of the long term money "storage" vehicles. And then the whole system will collapse.

The Fed will do literally anything to keep this from happening. As I said, they will save the system at ANY cost. This could mean any number of things, including things we haven't even considered yet. But most likely it will mean buying more junk from the banks with printed funds. The Fed will do what it did last year and print up another trillion or two and swap it for whatever toxic waste the banks still have, injecting massive liquidity into the system.

The US creditors will see this and know what is going on, and the T-bond market will suffer. The Fed will also cover that problem. It is a vicious cycle.

Denninger's prediction of a spike in the dollar is for short term traders. It has nothing to do with any fundamental strength. In fact, it could end up being the final pass-through for the dollar if things go badly enough. I certainly wouldn't trade it except for with funds you are willing to lose. Remember that the real leverage is in the final move that physical gold will make. The biggest profits will come to those who sit and wait.

As the parity between paper gold and physical gold breaks we will see the paper price of gold go down. I have no idea if that will happen here or at $2,000 or $3,000 or $10,000. But at some point the price of paper gold will reflect the price of the paper, not the gold.

So if I saw the dollar shooting sky high and gold crashing, I would wonder if this might be happening now. I would wonder if Exter's inverse pyramid was collapsing before my very eyes, as panicked funds exit massive positions trying to pass through the bottleneck of the transactional money supply and get into physical only. Of course much of it will be trapped in the dollar until the physical price of gold resets MUCH higher.

Just some things to consider when you hear stories of potential systemic failure and the writer suggests going long the dollar and short commodities (gold?). A spike in the dollar may just be its death knell. We are approaching the end of Jim Sinclair's countdown that was based on external dollar forces. Karl is looking at the internal problems. I'm sure Sinclair's external friends are as well!

Sincerely,

FOFOA

Hi Raptor,

You are very sharp. Nothing gets by you, does it?

Raptor is correct, for all you newbies! The title of my last three posts is very misleading!

Freegold is NOT a new gold standard. Gold is NOT money the way we think of money. Gold is a valuable item to store, as Gary North says. Gold is THE wealth reserve par excellence. Gold will replace Wall Street, not the dollar. We will still have fiat currencies! Gold's wealth function will act as the counterbalance against the fiat currencies, as a true representation of the real world wealth against which they are priced.

Raptor, isn't it amazing how some people get more from the title than they do from the body of an article?

:)

But in fact, each person is probably getting what they need to get from it at that time. Hopefully it is good enough that they will come back like you did. If it is not, then I need to do a better job. It is impossible to distribute all information in one post. You reach a point of diminishing returns if you try to pack too much into one piece.

I'm glad you are reading Raptor.

Sincerely,

FOFOA

DiverCity,

My best advice is not to go "all in", unless that is your level of understanding and confidence. Obviously in your case it is not. My best advice is to only put as much into physical gold as you are comfortable with. A percentage that matches your understanding of gold. For some people that is 20%. For others it is 100%.

As long as you put in more than 10% you will probably preserve and even increase your purchasing power! :)

The higher the percent, the more life changing this one-time event will be!

FOFOA

Hi Buster,

If the horse is already dead, what is the harm in beating it? And in your scenario, what good does the flogging do?

"Could you give an outline of how the transition from $$ and other fiats will progress?"

I don't think we will see an end to fiat currencies or even to the dollar. We may see the end of the dollar through hyperinflation, but even a severely devalued currency can still survive. Look at the peso! The transition I see lies mainly in the way savers and net producers will store their excess wealth. They will transition from debt-based storage to equity-based storage, primarily gold. This will remove the ability of the hungry collective to surreptitiously steal from the savers and producers. This will also remove the ability of the US to live above its means. It will force the world into a new meritocracy.

You should read some of my older posts. They explain my position in more detail.

Sincerely,

FOFOA

The story on a dollar rally and collapse of the system is a possible scenario indeed. However, as Fofoa says, the Fed will do anything to protect the system. Therefore I do not deem it very likely that the collapse Denninger is predicting will totally crash the system yet. I will turn loose some more screws, but not crash it yet I guess.

Going long the dollar and short gold might indeed turn out to be a profitable strategy, but as Fofoa indicates, it is also a very risky one, as it is not assured the system will survive.

I got my seat at this game of musical chairs! 100% in!

And I hope the dollar goes up and gold down like Denninger says. Because I will short the dollar to the depths of Hades and buy Gold as it finds a bottom.

And when Gold snaps back into the stratosphere, I will watch smugly as the paper bugs burn!

Skrew this paper system!

Do you people realize how evil this system is? Do you not realize this system hurts the weakest people of our societies? The people on fixed incomes- widows, orphans, single mothers, and the elderly.

Today I saw a program on Russia on TV. It picture a Russian millionaire that ran for the presidency in the past and is now trying to set up a gold coin system from Moscow. According to him Russian civilians were trained like Olympic athletes on withstanding crises, and introducing gold money was the best thing he could do for the people and himself.

@ Martijn 1:42

Just realize the law of Vilfredo Pareto, or in plain english 80/20 rule !

raptor:

DiverCity,

I would recommend like FOFOA said at least 10% of your FREE money (you would have to have at least 3-8 months cash to live, all the time, depending on your situation).

Then from the rest of the money you can have 10%++ in physical.. the rest depends.

One options is if you are not totally sure we will get a full collapse - go the paper route, but not with GLD and SLV ... but instead into CEF and/or GTU plus may be bullionvalut.com, and some mining companies .. Why ?

Because those are more safe protection than pure cash and are backed by audited gold/silver.

But here is one big IF.... at the moment you see the-BIG-panic in the market you should be READY on the sell button.. ;) .. and sell even if you expect the physical to skyrocket even more.

(In total-decoupling of the gold even CEF>I may not be safe enough).

You would wanna get your cash and spend it for stuff, if such time arrives.

What do you achieve with this : you are not totally locked in physical (that is IF you are not 100% sure in FOFOA predictions). You wont preserve all of your purchasing power, but at least you will preserve some..

That is not investment advice...but my idea how you can HEDGE! (mind you this differs from SAVE ) if we don't get totally "black/white" event but "grey" event..

Also another good hedge is if you buy a house with mortgage which you have NO PROBLEMS paying over time and can wait at least 5-7 years. Which is to say you would live there ;)

House is good hedge cause it lowers your tax burden too, esp. if we morph to high inflation environment for longer period of time...

Just set some positions and then re-balance over time as the events unfold.

It sucks that there is no 100% guarantee, but that is life ;)

again this is just my 5c

PS> In my country in 1992 we had 200% inflation in a matter of month and I preserved my purchasing power by accident cause I had my money 50% in dollars and 50% in our own currency...

but back then I was clueless about all this economic mumbo-jumbo :), my point is if you don't know what to do trust your COMMON SENSE.. and know money history ;)

raptor:

hi FOFOA,

I would love for you to elaborate on WHEN we will hit the FAN for sure. Probably like back on the envelope calculation. Having the following USA data :

GDP ~14T

Tax income 2.2T

Debt 11T

Interest payments : 300-400B (afaik!)

Deficit 2008 : 500B

Deficit 2009 : ~2T

Deficit for the next X years : min. 1T per year

From what I read on the internet..

I'm in opinion that the real crisis will be triggered by external credit event... i.e. the foreigners will slow..then stop.. then sell the debt.

I think this will be the cause of the high inflation or runaway inflation ..

So I guess my questions is at which point it wont be tolerable for the foreigners to buy anymore ?

Then as a side fact I'm also aware of the possibility that the foreigners may stop buying ty's just because they don't have enough savings anymore and they would like better to spend those money in their respective countries.

Not because of them being hostile to usa, but because they can't buy anymore.

I'm also aware that in the last couple of months foreigners have become found of the idea of diversifying themselves...

The problems is that it is very hard to quantify all those thoughts, so I can get some idea of the timing of the events to come.

As a guideline :

We can be sure the interest payments can't go close to 2.2T (tax collected).

Other limiting factor is probably Debt/GDP ratio.

Total Debt of above 20T is probably another psychological barrier.

Dollar as measured by Weighted-Fed-USD index or USDX dropping more than 50% in a year is another good indicator.

Raptor,

I don't do technical analysis and I don't do timings. But I can tell you that what is coming will defy all TA when it happens. It won't fit the predictions and it will surprise everyone. And I will be surprised if it is not sooner rather than later.

What is coming will be a sort of a "bank run" on value held within the system. Everyone will try to withdraw their "value" all at once. But value in the financial system exists only in fractional reserve, and the fraction is shrinking every day.

I don't know who will start the run, but there are many possibilities. It will be a psychologically driven event. Calculations won't mean anything. We are already far enough along for psychology to take over.

FOFOA

Thanks FOFOA and raptor for the responses -- I'm probably like you in the 90's, raptor, in that I'm sort of where you suggest, although not as a result of careful planning but rather some luck and natural conservatism in financial matters. I have a mortgage I can well afford if my income stays relatively constant and I have some PM's, about half of the value of which is in silver. I'd like to get out of that and into gold at some opportune time. The cash "savings" I have are what worry me in that I think they might go poof in the night. Oh well, such is the risk of being indecisive.

In this evolution we return to what was always in the system. The 'natural selection' of the fiat money system will return to it's earliest roots. Nothing new will have been created, just all the illusions, pretentions and delusions will be revealed for what they always were! There will not even be a smoking ruin as smoke can only be created by burning something that physically existed in the first place. The ultimate effect will be like the turning off of a hologram image projected into a vacumn.

Michael S. Rozeff has an interesting article/model on Lewrockwell.com talking about putting a dollar price on gold related to the posts on here. He draws a line from gold, to currency and reserves (monetary base), to 'money' created by banks (through loans), to good loans and bad loans (how much of the bank money actually has real world value behind it).

"Zero Discount Value of Gold in the Total Banking System

...Applied to the central bank whose only asset is gold and whose liabilities are currency and bank reserves, the ZDV is a value for gold such that every outstanding dollar liability in the central bank’s monetary base (currency plus bank reserves) is backed by an equivalent dollar’s worth of gold. It is what the dollar price of gold would be if the central bank’s liabilities were 100 percent backed or covered by gold...

The central bank has Assets of gold, or G, which is a certain number of ounces of gold. Its liabilities are Currency of 1 and Reserves of 1. The Reserves are the deposits of the banks. This fifty-fifty split between currency and reserves is roughly the current situation at the FED. The ZDV of the central bank is (R + C )/G = (1 + 1)/G = 2/G. With gold later to be taken as 261.5 million ounces and the bank’s numbers expressed in trillions, the central bank’s ZDV is $2 trillion/261.5 million oz. = $7,648 per oz. This is actually quite close to the FED’s ZDV at present, which I estimate to be $7,456...

Bad loans are loans that fail to provide the full amount of the promised payments. Any losses in value of bad loans below the promised payments mean that borrowers have not collected enough dollars from their customers or jobs to write checks to the banks and reduce deposits. The dollars remain in the system as deposits. How so? If a borrower has bought a house on a mortgage loan that he cannot repay, he has written a check to the house’s owner. That seller then has those funds on deposit in his account. They will only be offset when the borrower pays off the bank loan. If he is unable to do this, then bank deposits or bank money do not shrink. But since the bad loan has reduced or no market worth, we see that bad loans reduce the loan backing of the still outstanding dollar deposits that were created against them...

A 10 percent drop in loan value (h = 0.1) caused the ZDV to rise from $7,648 to $11,090."

For what it's worth - just putting it out there - a couple of weeks ago I commented on the correlation between Legatus meetings and tops in equities. Well, the pattern appears to have held. The meeting was over on October 19 and market peak was on the 20th. I find the correlation interesting and a bit unnerving. As far as equities bottoming out, and total heck truly beginning, I believe Martin Armstrong has mentioned April or May 2010. It is my staunch belief that Fofoa is correct in the medium/long term and that's all that really matters - the other stuff is just speculation.

Hi FOFOA,

Do you remember in the not too distant past that the ECB said to not use Euro’s for the oil trade? They stated something to the effect, there simply wasn’t enough and it would drive demand so much as to create too strong a currency?

Fast forward to today where our fearless leader (http://jsmineset.com/) links to the Iranian Oil Bourse news (http://www.zawya.com/Story.cfm/sidZAWYA20091027060706/Iran:%20Oil%20bourse%20inaugurated). If you read closely they will trade “… in various currencies, primarily the euro and Iranian rial, and a basket of other major currencies.” And, from the letter they sent to Japanese oil refiners, we know they are currently trading in Yen.

Have to wonder how close we are to the point where the strength of other currencies – through usage demand – will level the dollar’s playing field?

It has been predicted that key strength for the euro will come from oil backing. The Yen has been strengthening with a little oil backing. To some, the Euro seems overvalued, but maybe this will add a little more strength.

---

Good articles. Your commitment to public education will definitely lead to a rosy future!

"The dollar is already dead, it's just everyone in the world is trying to figure out how to unwind their positions without creating panic. It's a big house of cards with everyone who understands whats really goin on trying to slowly pull their cards out. One day someone is going to pull too hard too quick and things will get very interesting."

"While gamblers can continue to use GLD-NYSE for trading purposes, those who are using GLD to buy and hold gold as a replacement for physical gold, in my view, are making a major error and quite possibly a fatal one."

"This is the real deal. This is not 1979, the era of greed. This is the era of fear. Panic and rash action will not help you. It's important to understand that the risk of repeated bank and brokerage closures is high, and means you may not be able to trade stock for intermittent periods of time. For those of you who have ordered safes for your home, keep in mind that the companies you ordered from employ workers who could receive "invitations" from criminal gangs to supply them with lists of the customers."

(Costco has good safes. If you don't have a pickup truck, a hand-truck dolly, and a few power tools, try renting them from U-haul. It can be a one-man job to install even a tall safe!)

True story;

a friend of my mums had to do Jury Duty once - the case was for a guy who had been caught stealing stuff from peoples homes....

My mums friend was shocked - because this same guy was the one who had installed her safe.

Memo - if you gonna buy a safe - install it yourself and tell no one.

"Get Out of Bonds -- Fast!... Individual investors have pumped record amounts of cash into bond mutual funds this year, just like they did in stock funds in 1999. I believe that with the first rumor of a failed Treasury auction, investors will finally flee bonds in droves. The monthly record supply of bonds and the coming decline in demand is all that's needed to spell disaster for the bond market... Mr. Bernanke is going to have to make a decision soon between sacrificing the stock market or the bond market." (Minyanville)

"Safety" deposit boxes!!

"More than 500 officers smashed their way into thousands of safety-deposit boxes to retrieve guns, drugs and millions of pounds of criminal assets. At least, that’s what was supposed to happen. Adrian Levy and Cathy Scott-Clark investigate...

What really happened was that the vast majority of those caught up in the raids (called Operation Rize) were innocent. They had their lives turned upside down and many have been forced into legal trench warfare with police lawyers and told they must prove how they came by the contents of their boxes...

One survivor of Nazi Germany in his seventies told us how he had placed a bag of diamonds there - security if ever he or his descendents needed to run again..."

A Must Must Read

fofoa please comment on this:

http://georgewashington2.blogspot.com/2009/10/is-david-bloom-wrong-about-dollar.html

I can't thank you enough for you're economic brilliance!

You guys should check this out!

http://www.zerohedge.com/article/increasing-signs-stress-citi

A seemingly simple post turned real ugly yesterday.

Looks like the debt slave sheeple are starting to awake!

Hello Anonymous (6:05PM),

Here are some thoughts and comments as you requested:

We need to keep a few principles in mind in order to understand what is being discussed in these confusing discussions about a liquidity crisis, currency swaps, and supposed dollar strength. My apologies if I simplify this too much for your taste, but my thoughts are simple ones...

1) First of all, what are all banks and bankers afraid of? A run!

2) Drastic currency devaluations coincide with a multiplication of the monetary base, not the credit expansion of wider monetary measurements.

3) The USDX measures the supply and demand of actual base money needed for transaction clearing, not the willingness of banks to stick their necks out further. Base money is the "reserve" in the term "fractional reserve banking". We could call it "fractional base money banking".

4) Currency devaluations are long term and permanent. USDX quotes are short term and temporary.

5) There is no difference between the $ and the $-financial industry ($-FI). What is bad for one is bad for the other. A run on the system is just as bad as a run on the banks, or a run on the dollar. Any run screws them all.

6) Much of what we all think of as money (dollars) is not really dollars in the same sense as the dollars needed in a liquidity crisis. We think of money mostly as M2. But a liquidity crisis requires MB (Monetary Base, or base money)

7) "The system", meaning the worldwide financial industry is divided into sub-systems; The Federal Reserve system, the Eurozone system, the British system, etc... What differentiates these sub-systems from one another is their own currency, which can be created on a whim by the central bank and lent to banks that need extra funds with the CB taking collateral from the borrowing bank in the form of assets denominated in that currency.

8) Each sub-system is a completely interconnected network of financial institutions, including commercial banks, investment banks, brokerages, etc... 99% of all transactions within each sub-system clear without ever having to move money (dollars). For example, within the bigger banks, most transactions clear in-house. One person might buy a house, taking out a new loan for $100,000 while some other bank customer sells his house paying off his $100,000 loan. These two transactions cancel each other out in-house. Inter-bank transactions cancel each other out as well. For the most part, finance and banking is a zero-sum game within each sub-system, from stock transactions to bond transactions to new loans to settled loans to you writing a check to your dentist. If one bank ends up with more at the end of the day and another with less, then the central bank clears the trade with a book entry transferring "reserves" from one bank to the other. Even new loans do not really create the kind of money that is needed in a liquidity crisis. They create credits issued by the bank, liabilities that are counterbalanced by the debt papers you signed. Those credits entitle to bearer to dip into the bank's actual dollar reserves, but do not create new dollars. The only new dollars that get created are when the bank must move funds to cover fractional reserve requirements. Those funds then become new monetary base. THOSE are the kinds of dollars needed in a liquidity crisis.

...

...

9) Each sub-system has a TREMENDOUS amount of flexibility since the CB acts as the ultimate clearing house between all the financial institutions in that sub-system. And since we are now on a purely symbolic fiat currency, the CB can create any liquidity the system needs. If one bank comes up so short at the end of the day, owing another bank more reserves than it has, then the CB just creates new reserves and lends them to the bank that is short and the CB takes assets (from the borrowing bank) onto its own balance sheet to counterbalance and collateralize the loan of fresh new money. This flexibility has virtually eliminated all banking liquidity problems within any given sub-system. Only an actual bank run on physical cash within a sub-system presents a real threat. And if that run happens to only one bank in that sub-system, then that bank is sacrificed. If a sub-system-wide run on cash were to happen, we would have a bank holiday while they figured out the best way to devalue the monetary base and increase it.

10) Viewing the whole worldwide financial system, in which the BIS acts as the ultimate clearing house, there is much less flexibility because the BIS does not print the currencies it clears. The BIS would prefer ITS central clearing to be done in gold bullion, stored in its vaults and moved from one countries slot to another when necessary. But the $-system doesn't want to play that game. Even still, 99% of the worldwide transactions clear without the need to transfer any funds around... as long as it is a "business as usual" day.

11) Problems start to arise in the international clearing house when daily transactions become unbalanced, meaning too many people trying to do the same thing all at once, with no one willing to do the opposite thing. The two sides of a zero-sum game are never in perfect balance, but they are usually close enough that market pricing takes care of the difference. (If there are too many sellers then the price drops until the sellers equal the buyers.) But sometimes an event happens that spooks the markets and sends everyone to one side of a trade all at once. Prices go into free fall which spooks the markets even more. Then the exchanges are shut down "to let cooler heads prevail". But this only spooks the market further. Finally, at the end of the day, the clearing house is left with a big one-sided mess to clean up.

12) Here is the big problem. Each of these sub-systems has its own currency which its CB can print at will... flexibility! But with the dollar being the global reserve currency, there are lots and lots of dollar-denominated assets held by financial institutions in many non-$ sub-systems. So when there is turmoil in the dollar-denominated markets, the non-dollar sub-systems run into a clearing problem because they can't print dollars to help banks that owe other banks more dollars than they have. So they turn to the BIS, who also can't print dollars. Only the Fed can. So the Fed ends up being the de facto CB to the world. But it is not the clearing house for the world, and it does not take assets onto its books from those foreign banks that got into trouble. Instead, it lends directly to the other CB's which print some of their own new currency and send it to the Fed in exchange. This is why it is called a "swap" instead of Quantitative Easing. They are swapping freshly printed currencies instead of assets for currencies. All base money! The same as cash. TWICE as potentially inflationary as QE on a global scale because two sides are now exposed to currency risk.

...

...

13) When the Fed makes these international currency swaps, it doesn't send pallets of hundred dollar bills on a plane. It simply makes a contract with the foreign CB and a book entry. The contract is a two-way promise to later provide pallets of physical cash if anything goes wrong and cash is needed. And with this promise in hand, the foreign CB makes a similar contract (promise) with the European bank that got in trouble. The foreign CB promises to later provide physical cash if necessary (if something goes wrong), and the bank submits assets to the CB as collateral. Next the troubled bank passes those dollar promises (IOUs) on to the bank it owes the dollars to and that bank credits its customer's account with dollars it doesn't have, but now has indirect access to (if needed). The idea is that as things return to normal and transactions start clearing in a more balanced state that ultimately the dollars that were needed will be able to be gotten on the open market without causing a spike in the price and they can work their way back to the foreign CB. The troubled bank, for example, can later trade assets for dollars and pay back the foreign CB which will then pass those physical dollars on to the bank holding the IOU. And now that the European problem has been cleared, the foreign CB can cancel that portion of the two-way swap agreement with the Fed. And no physical dollars need cross the ocean. And that portion of the currency risk is eliminated.

14) Base money is either physical cash or a liability (IOU) that traces directly back to the Fed, which includes reserves held at the Fed. In other words, it is physical cash, or the promise of physical cash from he who can print physical cash. The Fed is willing to issue these promises willy nilly but hopes it doesn't actually end up having to do the printing.

15) The USDX is a measure of dollar exchanges with other currencies that happen on the open market. The Fed can counteract a rise in open market dollar demand by providing a supply of dollars directly to banks within its own sub-system, or indirectly to foreign banks through swaps with other CB's. Last year the Fed had a lot of practice doing this fast. I am sure the contractual transaction with the foreign CB's took several hours and included recording video teleconferences in which the agreements were legally bound. But now that they have experience doing this in a crisis, next time it will probably be almost instantaneous.

16) So as long as there is more demand for dollars than supply, the Fed can control the price of the dollar on the USDX by its own willingness to lend dollars at zero interest with toxic assets or foreign currency as collateral. This costs the Fed nothing, except currency risk and bad PR at blogs like mine. But where the Fed loses control is when there is more supply than demand. And that is what is coming because of this very inflationary policy of providing dollars to save the system at any cost.

17) The problem is with the assets that are being swapped around for dollars, whether with the Fed or with the foreign CB's. These assets are becoming less and less liquid because they are not valued correctly. If they were valued correctly, the banks would be insolvent and have to file bankruptcy. They wouldn't even have enough assets to settle their debts by swapping with the CB's. This is why the assets need to remain marked to myth. But this makes the assets only sellable to the CB's. The open market doesn't want them. So the clearing mechanism that is needed to reverse the flow of supposedly temporary base money into the system is breaking down. The Fed tells us with a straight face that it can reverse everything it has done so far. But that is only the case if the free, open market is willing to take up all the slack the Fed put out there by private investors buying toxic assets at marked to model prices.

...

...

18) So the next time the Fed has to create a trillion new dollars of liquidity, it is likely going to stick in the system as base money that cannot be removed. Ultimately the Fed will be contractually obligated to print actual bills and supply them to the banks and CB's that hold the contract for them. And this is what devalues the dollar.

Conclusions: The USDX is a rather poor metric by which to judge the dollar, even in the short term. As long as there is a demand for base dollars, like there is in a panic or a crisis, the Fed has total control over whether it wants to let that demand bid the dollars on the open market, or provide them itself. And the Fed cares more about the financial system than the value of the dollar, so it will surely provide any liquidity that is needed.

The next crisis, if it is mainly in the US financial system, will likely not spike the dollar because the Fed has total control and flexibility within its own system. If it is spread throughout the world it may spike as foreign banks bid up dollars on the exchange, but the Fed is now more experienced than it was a year ago and will likely put a lid on it very quickly.

But this next dollar shock will probably be irreversible, unlike the last. And in such, it will increase the global supply of dollar monetary base by a large percent. Perhaps by 100% or more. This alone will devalue the dollar and be the cause of the next shock which will require a similar response by the Fed, perhaps increasing the base by another 50% as China and others dump the last of their bonds onto the open market in a highly one-sided transaction sending the value of the bonds to zero, US interest rates to something so high they are non-existent, and the purchasing power of the dollar down into the stinky, Zimbabwe dirt.

So in short, I guess I agree with David Bloom. Of course it COULD rally, but I don't think the Fed will let it (unless it happens to have some T-bonds to sell that week!). Letting it rally too high would crush the financial system (by driving asset values into the dirt) which the Fed wants to save at any cost. Even though the cost will be the crushing of the system. The ol' Catch-22.

Sorry if this seemed a bit simplistic or a little elementary. Of course there are more complicated issues involved, like the $ carry trade and cross-currency investments. Derived foreign exchange activities become very complicated very fast! Too complicated for the banks, obviously! But I hope I at least covered the basics of the problem, enough to explain my answer. You all will be sure to let me know if I got something wrong... I am sure of that! ;)

Sincerely,

FOFOA

PS. This is the big secret that George F. Baker didn't want to tell Congress in 1913. That most all of what we think is money is really just promises issued by banks to supposedly credit-worthy entities giving them the right to withdraw value from a small reserve of actual money, but at the same time praying to God that they don't! It's like saying, "here you go, it's all your's, whenever you want it come and get it" with their fingers crossed behind their backs hoping you won't ever actually "come and get it".

But whatever happens in the short term, the USDX will ultimately collapse just as Jim Sinclair says because ultimately is DOES represent a preference of currencies for use in international trade. And we know where that is heading, especially while the Fed hyperinflates the MB trying to save its own precious global $-FI!

Correction. On #2 I should have said...

2) Hyperinflation coincide with a multiplication of the monetary base (which is the natural CB response to the panicked marketplace devaluing the "broad money" which is actually near-cash credit assets), not from the credit expansion of the broader monetary measurements by commercial banks.

FOFOA, Could you please turn these wonderful last replies into a post? They clear up yet another whole lot rubbish (this time about "dollar demand") that simply did not make sense in anything else I have read. It is difficult to send the comments link to my friends who should read it.

ps. Do not apologize for being "a bit simplistic or a little elementary". It is never simple to express yourself with such clarity.

FOFOA, based on what you posted...

9) Each sub-system has a TREMENDOUS amount of flexibility since the CB acts as the ultimate clearing house between all the financial institutions in that sub-system. And since we are now on a purely symbolic fiat currency, the CB can create any liquidity the system needs. If one bank comes up so short at the end of the day, owing another bank more reserves than it has, then the CB just creates new reserves and lends them to the bank that is short and the CB takes assets (from the borrowing bank) onto its own balance sheet to counterbalance and collateralize the loan of fresh new money. This flexibility has virtually eliminated all banking liquidity problems within any given sub-system. Only an actual bank run on physical cash within a sub-system presents a real threat. And if that run happens to only one bank in that sub-system, then that bank is sacrificed. If a sub-system-wide run on cash were to happen, we would have a bank holiday while they figured out the best way to devalue the monetary base and increase it.

... Then why is the FDIC closing so many banks?

fofoa - check out the post on ZH re M2 here vs. EC with the implications on M3 reporting and the liklihood that the ECB will eventually have to debase. In effect the argument is that the CBs are sequencing devalueation to support bond auctions etc.

Spot on analysis: the problem is that the equilibrium GDP is more like 9T (maybe lower) vs. the $15T reported. As such printing money serves only to support the bubble like asset valuations which in turn supports the bank asset balance sheets (loans) not to mention their securities portfolios. Indeed, the I have neveer seen an analysis of that the systemic cost owuld be of taking out the big banks and carving them down both to bondholders, depositors , jutual funds and insurance ocmplex (pensions). Whatever it is, the cost is substantial and justifes the printing regime to play make believe. Of course this leaves aside the draconian geopoltiical implications of having the robe pulled back. The single greatest tell for in this past few months was the report that France was part of that anti dollar axis of evil. The French invented realpolitik.

I'd be interested in your thoughts on the M2 - M3 debate and the ECB catchup. I think you are correct that the rest of the world is biding their time before moving off the standard. The notion that germany is issuing in dollars says something loud and clear. A bundesbank that is notoriously conservative?/hawkish?

Interesting peace from our friend Ambrose guys.

click

Stories like these help you in keeping an open mind.

Another interesting new piece of information. A view from another angle from FEKETE.

http://www.professorfekete.com/articles/AEFForgottenAnniversary.pdf

Hello S,

You say, "I'd be interested in your thoughts on the M2 - M3 debate and the ECB catchup."

Here are my thoughts...

1) Tyler says that money market funds are M3 in both Europe and the US. But actually, money market funds owned by individuals are counted as part of M2 in the US. These are most definitely not money. They are assets which is how they can, in a crisis, "break the buck".

Fed --> "M2 consists of... balances in retail money market mutual funds, less IRA and Keogh balances at money market mutual funds."

2) Tyler asks: "This begs the question: does Europe anticipate not having budget deficits of the same magnitude as America?" I would remind you of Wim Duisenberg's famous speech about the Euro... "The euro, probably more than any other currency, represents the mutual confidence at the heart of our community. It is the first currency that has not only severed its link to gold, but also its link to the nation-state. It is not backed by the durability of the metal or by the authority of the state."

NATION-STATE - This is the difference between the Euro and the Dollar. The US uses its currency to fund its massive deficits. The Euro was not set up this way! The Euro is a shared community currency.

3) The ECB faces a tug of war between its various powerful members regarding monetary policy. In this way it is nothing like the Fed. Trichet is a lot more like Bernanke than the Germans would prefer, but still he must play the Euro game which is not the same.

4) Basically, I think there are a few simple flaws in his analysis.

Sincerely,

FOFOA

Hello Allen,

"... Then why is the FDIC closing so many banks?"

The FDIC is closing banks because they are insolvent. This is actually a systemic problem as so much of the asset base is built upon the housing and commercial real estate sectors. But the bigger banks are being protected by accounting rules that let them lie about the value of their complex derivatives.

The smaller banks still hold a lot of raw mortgages they issued... not yet securitized. These are harder to lie about. Many banks are lying by not foreclosing even on badly delinquent homeowners. But this is only making the problem worse and "kicking the can down the road".

These smaller banks don't have the assets to acquire the loans they need to cover their liabilities. They are insolvent, just like the big banks, but they can't hide it anymore, thus they get closed.

This is what people mean when they say, "this is not a liquidity crisis, it is an insolvency crisis". "Liquidity" means being able to get money for your assets from the CB (or from the open market). "Insolvency" means you don't even have the asset values to do that! I should have addressed this too, but my comment was so long and it was so late when I was writing it.

Sincerely,

FOFOA

Hello Ephemeron,

I will think about making this into a post. Thank you for your nice comment! Did you know there are permalinks to comments as well? Here is the one to my comment ---> Dollar liquidity

Sincerely,

FOFOA

Hi Shanti!

Thanks for the heads-up on the new Fekete! Here are some comments I had on his article/speech...

Wouldn't it be great if they just did away with all legal tender laws? Perhaps they could just keep one stating how they want you to pay your taxes. But let the courts defend any and all contractual agreements no matter what they are denominated in. And open the mint to free coinage! Of course this is all part of the world that SHOULD be, not the one that WILL be. So it doesn't give us much guidance for preserving (and increasing) the purchasing power we have NOW.

Isn't it interesting that the legal tender laws came out in 1909, just two years after the panic of 1907? As Fekete says, they led to the governmental ability to finance the world wars. But is legal tender really the problem? Or is it that the people continued to confuse the store of value function with the other monetary functions? If we now return back to the system of 1906, are we not returning to a system that has already reached a less than ideal end several times? Perhaps it would be better to embrace the separation of monetary functions as this will take away the ability to finance wars the same as a new gold standard would. Right?

Is it really the forcing of paper to be used as money (medium of exchange/unit of account) that allows the collective to rob the citizens? Or is it the conning of people into holding said paper as a store of value?? I think it is the latter much more than the former. Both to some extent, but more so the latter.

If people only hold the currency for the short time period of the medium of exchange function, then there is much less for the inflation tax to tax. The higher they turn up the inflation tax, the shorter the time people will hold the paper. In this case, the inflation tax would only be on the difference between your work contribution to the economy and what you could buy with your paycheck two weeks later. And the tax base would be limited to the amount of currency in circulation. But if people hold paper as wealth, the taxable base is orders of magnitude larger, and the inflation tax can be administered more slowly and surreptitiously because of the larger "tax base".

...

...

Imagine if every saver in 1909 started holding only gold coins in his possession as soon as they passed the legal tender laws. The parity between paper and physical gold would have snapped long before even the roaring 20's. Roosevelt would have confiscated gold valued in the many hundreds. But people trusted their governments back then. So it was easy to CONvince people that it was better to hold paper with a "yield"!

Fekete notes that no one hoarded gold until AFTER war started in 1914, at which time gold "went into hiding". But imagine if gold went into hiding in 1909 right after the legal tender laws were introduced. Perhaps then, there would not have been war at all. Or at least it would not have been so well funded!

It would sure be nice if Fekete would apply his brilliant mind to this Freegold concept! But alas, he is advocating for a new gold standard. A non-inflationary system, so we can all hold the same money we use in trade as a store of value.