Let's try this one more time. Let's look at it from a purely conceptual angle. Most of the following discussion will not be a proof of the inevitability of hyperinflation, but merely the proper way to view the flow of capital in a panic while analyzing the probability that it will be called "hyperinflation" in hindsight, after the fact. This is what seems to be most lacking in the descriptions I read from those who cannot accept that fiat currencies always end the same way, and that the dollar has reached the end of its timeline.

To get there, I will walk you through several visualized metaphors in an attempt to build a workable mental image of hyperinflation. Hopefully you will be able to use this mental imagery when analyzing the deflationists' claims that it simply cannot happen to the US dollar.

So first, I would like you to imagine two flat, parallel planes. Those that know M theory can envision two membranes, very close to each other but only touching at a single point:

The top plane we'll call "the monetary plane" and the bottom one will be "the physical plane." And just so that we don't get confused with "the flat Earth society," those of you with advanced visualization skills can picture this same scheme as a globe with a membrane (or a Matrix of sorts) wrapped around it but not actually touching:

Now, for the purpose of this visualization exercise, I am going to challenge your definition of the word "money." In all likelihood you think of money as that which is substituted in the middle of a barter exchange. Something like this:

There is no right or wrong definition of the word "money," there are only poorly defined uses and clearly defined uses of the word. In the context of any single discussion, it is better to use a clear definition than to simply rely on everyone's common understanding.

In this discussion I will be talking about "the monetary plane," and in this context the word "money" refers to BOTH the medium of exchange and all forms of wealth reserves that exist in this "monetary plane." That is, "money" in this discussion is the medium of exchange PLUS any store of value that is not found in "the physical plane" of existence. Hopefully this is clear enough so that I don't have to add another three pages of descriptions.

In antiquity, the monetary plane didn't even exist. All wealth was held in the physical plane. In fact, even the medium of exchange was in the physical plane back then. So in that way, it was actually a barter exchange of one physical item for another, even if the other physical item was a chunk of gold. That chunk of gold existed in the physical plane. And for the purpose of this particular discussion, I hope this distinction is clear.

In today's monetary plane, enormous amounts of wealth are held as "someone else's thoughts of value" not value itself. And as ANOTHER once said, "time moves the minds of people to change, and with this, the thoughts of value also change. In this day, as not in the past, the loss of paper value as a concept will destroy the very foundation of wealth that this economic system is built on. This drama has started and is well underway!"

Credibility Inflation

Referring to my post, during times of credibility inflation the monetary plane swells large along with its credibility. One way to picture this is an hourglass, as I did in Gold is Wealth:

The top of the hourglass is the monetary plane and the bottom is the physical plane. And during times of credibility inflation, sand accumulates in great quantities in the top. Here are my pyramids representing the two planes from that same post, stacked on top of each other in a visual similar to the hourglass:

As I said in my Credibility Inflation post, the latest period of credibility inflation ran from 1980 until 2007. Since then, the credibility of the monetary plane has been deflating against the protestations of the Fed and CNBC. That doesn't necessarily mean the sand has gone down the hourglass yet, but its desire to cross the "bottleneck" is growing as the credibility of the top part deflates.

The stage for this was already set when the top swelled too large for the bottom to handle over the past 30 years:

Gravity alone would have brought it down gradually but for the managed perception of credibility that was holding it up, even as pressure built. But with credibility now deflating (that's the REAL deflation) it's anybody's guess when the pressure of over-inflation will bring it exploding downward with a force much greater than gravity alone. It's overdue at this point, kinda like The Big One in LA.

Some of you may have already figured out that hyperinflation, in my visualization, will be the great flood under pressure from the monetary plane back down to the physical plane of existence. And you may have noticed that this great flood must pass through a "bottleneck" of sorts to get where it's going. And perhaps you surmised that, if under enough pressure, this hyper-flow could actually BREAK the fragile neck in the middle of the hourglass.

In my pyramid above, taken from my Gold is Wealth post, I have that "neck" represented by gold. That's because that particular post was more about my #1 topic, Freegold, while this post is about my #2 (of 2) topic, hyperinflation. So for the purpose of this post, I will change that "bridge" between the monetary plane and the physical plane to dollars. For the bottom I'll use physical dollars, since they do actually exist in the physical plane. And I'll change the second layer on the top to "broad money," representing "balance sheet money," M1, M2, M3, MZM, TMS etc…

Now when I say we have already hyperinflated the $IMFS (the Dollar International Monetary and Financial System) over the last 30 years, I am referring to this whole top pyramid:

When deflationists see monetary deflation, they are looking at this part, and they see the value of the dollar in this circle rising:

When they see price deflation, they are looking primarily at this part, and they see the value of real estate and other things in there falling:

But they are missing the significance of the bigger picture; that the credibility of the entire top of the pyramid is deflating. And it was this credibility that was holding all that sand up there in the first place. With the value of the top red circle falling and the value of the bottom red circle rising, the deflationists see "deflation."

But what I see is the beginning of a capital flow, in one particular (and significant) direction:

Legal tender laws mandate the medium of exchange, but they do not and cannot name the store of value. For that they rely on credibility management by institutions like the Fed and CNBC. Jim Sinclair calls this MOPE. And it is the monetary store of value that is on the move, not the medium of exchange. But thanks to legal tender laws the monetary store of value must pass through (and be priced in) the medium of exchange, dollars, whenever it is on the move.

Thanks to our legal tender laws, in order for all that "wealth" at the top of the upper pyramid to escape to the bottom pyramid it must pass through the dollar. But as this occurs, the dollar swells in value. It becomes "more expensive." It'll cost you more derivatives to buy a dollar in order to pass through the neck of the hourglass. The dollar becomes a little bit harder to get, and this starts to look like deflation to the deflationists.

Now I'm really not trying to gross you out in this next little bit. But in order to pass through my next explanation I am going to have to carefully and delicately shift metaphors... without visual aids this time. ;)

As escape pressure builds in the upper regions of the upper pyramid, the legal tender dollar constricts its escape route like a clinching sphincter muscle as its (the dollar's) price rises. And then all that value that escaped the upper region starts collecting and compacting in the large intestine of Treasury Bonds, held in place only by the swollen sphincter that is the swelling dollar.

Not that I hope you can relate to this metaphor – I'm sure some of you can – but what do you think happens when that "flow restrictor" lets go, just a tad? Do you think "just a tad" escapes? Perhaps… at first. But with the Fed shoveling Ex-Lax (QE) into the system like there's no tomorrow, what do you think the end result will be? Will it be a journey back up into the stomach?

I know I haven't proven anything in this post. But I warned you at the beginning that was not the goal. The goal here, as I stated at the top of this post, was to give you the proper way to view the flow of capital during a panic when analyzing the probability that it will be called "hyperinflation" after the fact.

Notice that there is nothing in this view about the addition of new dollars. There is nothing about printing wheelbarrows full of money. All that stuff is secondary to the initial blast that explosively exits through a very small opening.

The lesson I hope you'll take from this story is simple. The next time a deflationist tells you there is no possible mechanism for hyperinflation in the dollar, just show him your sphincter and say, "oh yeah?" ;)

This metaphor even holds for the Weimar hyperinflation. If we think about our 30 years of credibility inflation as "packing the musket" for hyperinflation, then we can view the first year and a half of the Weimar three-year experience in the same light: "packing the musket." From Wikipedia:

It is sometimes argued that Germany had to inflate its currency to pay the war reparations required under the Treaty of Versailles, but this is misleading, because the treaty did not allow payment in German currency. The German currency was relatively stable at about 60 Marks per US Dollar during the first half of 1921.[1]

But the "London ultimatum" in May 1921 demanded reparations in gold or foreign currency to be paid in annual installments of 2,000,000,000 (2 billion) goldmarks plus 26 percent of the value of Germany's exports. The first payment was paid when due in August 1921.[2] That was the beginning of an increasingly rapid devaluation of the Mark which fell to less than one third of a cent by November 1921 (approx. 330 Marks per US Dollar).

The total reparations demanded was 132,000,000,000 (132 billion) goldmarks which was far more than the total German gold or foreign exchange. An attempt was made by Germany to buy foreign exchange with Marks backed by treasury bills and commercial debts, but that only increased the speed of devaluation. The monetary policy at this time was highly influenced by the Chartalism, and was notably criticized at the time from economists ranging from John Maynard Keynes to Ludwig von Mises.[3]

Yes, this is the same quote Mish used. Sounds pretty bad when you read that from August to November, in 1921, the Mark fell to less than one third of a cent! But it sounds less bad when you realize that it fell from only one and two thirds of a cent. That's like saying he fell to the bottom of the Grand Canyon without mentioning he was standing on an applebox at the bottom of the Grand Canyon. To restate: during this period the German Mark fell from 1.67 cents to .33 cents. Only an 80% fall. This was Germany's "packing the musket" phase, similar to our 30 years of credibility inflation.

At this point the Mark looked the same, and it actually stabilized for the next 6 months! But the musket was already packed, just waiting for the collapse of confidence. And the collapse of confidence is what brought hyperinflation to Germany. It came halfway through 1922 after a conference with U.S. investment banker J. P. Morgan Jr. produced no workable solution to Germany's problems. Here's the next part of the Wikipedia article that Mish didn't include:

During the first half of 1922 the Mark stabilized at about 320 Marks per Dollar accompanied by international reparations conferences including one in June 1922 organized by U.S. investment banker J. P. Morgan, Jr.[4] When these meetings produced no workable solution, the inflation changed to hyperinflation and the Mark fell to 8000 Marks per Dollar by December 1922.

This came later, as a reflex to the collapse of confidence

Hyperinflation was the result of the collapse of confidence after the conferences failed. The wheelbarrows that soon followed were the effect of this collapse of confidence, not the cause. The initial printing in 1921 "packed the musket." The loss of confidence in mid-1922 fired the musket. And then the real printing began out of necessity! By November of 1923 wheelbarrows were no longer big enough. The banks were counting their money by the ton.

An Afterthought

I realize that some of you are going to complain about "physical commodities" being on the top pyramid of my visuals. They are there as a class of speculative investments with its value anchored in the industrial use of those commodities which fluctuates along with the health of the economy. This industrial use value will disappear, at least temporarily, during a hyperinflation. And the actual commodities will retain an appropriate value through the hyperinflation out to the other side. But if they are bid up by speculation prior to the hyperinflationary event, their final value on the other side may actually be lower in real terms, even if it is much higher in nominal terms.

A monetary commodity, on the other hand, like gold, will rise because its value is anchored in the MONETARY use of the metal, as seen on the ECB balance sheet. So as you are deciding on a metal in which to ride this thing out, ask yourself in which function, monetary or industrial, is its value anchored. And you might just want to follow in the footsteps of the Giants, because they are clear and large, and easy to follow.

Sincerely,

FOFOA

For more on the gold angle in the above discussion, please read:

All Paper is STILL a short position on gold 3/23/09

Gold is Wealth 11/21/09

and Gold: The Ultimate Wealth Reserve 12/29/09

311 comments:

«Oldest ‹Older 201 – 311 of 311It matters not whether they understand.

All that matters is that they hold gold. And don't let go.

A wise man ought always to follow the paths beaten by great men, and to imitate those who have been supreme, so that if his ability does not equal theirs, at least it will savour of it. Let him act like the clever archers who, designing to hit the mark which yet appears too far distant, and knowing the limits to which the strength of their bow attains, take aim much higher than the mark, not to reach by their strength or arrow to so great a height, but to be able with the aid of so high an aim to hit the mark they wish to reach. - Nicolo Machiavelli

Gilligan,

Machiavelli offered brilliant insights into statecraft but that quote demonstrates that physics was not one of his strong points.

LOL.

Agreed.

@FOFOA said "You are all giving the US government far too much credit considering it is about to lose its golden goose ... What you think of as the big domineering federal government is nothing without public confidence in its currency, the physical dollar ... Hyperinflation will be fast.

Yep; really, nothing more need be said. As the old saying goes, "it's all over except for the crying".

One day in the not too distant future, we're going to wake up to discover the Union has dissolved. Individual states and/or regional confederations will have introduced some kind of greenback as they once again take control over base money creation and possibly private credit.

It's all actually happening today, like practically undetectable, miniscule forerunners to a tsunami. Yet for many who still retain a belief in magical thinking, the image of a strong, powerful Oz is hard to shake.

It's why religion is so prevalent - something in our evolutionary past favored those who were willing to suspend disbelief and faithfully embrace whatever the "leaders" were saying. It most likely has to do with allocation of communal food and defense against group violence.

Either way, it manifests itself today in completely illogical fallacies regarding the power of some 'entity' to regulate and control base human instincts as typified in true, open (aka 'black) markets.

When local/state/regional governments take over issuance of un-backed scrip, what will people really accept for valuable physical goods & services?

From USAGOLD....good quote from Randy.

ECB steps up its bond buys amid worries

Sep 20th, 2010 13:02 by News

by Brian Blackstone

September 20 (The Wall Street Journal) — The European Central Bank increased its purchases of government bonds last week amid rising concerns in financial markets about the ability of Greece, Ireland and Portugal to repay their debts.

Bond purchases by the ECB, though higher in recent weeks than during much of the summer, are still a fraction of what they were when the program started in May at the height of Europe’s fiscal crisis.

… The ECB said it spent €323 million on government bonds last week, up from €237 million the previous week and the highest since mid-August. It didn’t provide a country or maturity breakdown.

When the program started May 10, the ECB was much more aggressive, buying more than €16 billion in bonds the first week alone. … By early August, the ECB was buying only about €10 million a week in bonds, leading to speculation at the time that the program would soon end.

… The latest increase in debt purchases “is an illustration that the sovereign-debt crisis is surfacing again, but it’s not as severe as May,” says Carsten Brzeski, economist at ING Bank in Brussels.

… The ECB’s bond purchases “are not serving much of a purpose in their current size,” says Marco Annunziata, chief economist at lender UniCredit in London. … Yet ending the program altogether would add even more instability to already volatile debt markets. “It would create a lot of uncertainty,” Mr. Annunziata says.

[source]

RS View: As the ECB grows the size of the Eurosystem’s balance sheet through domestic bond purchases, a rising price of gold is a natural and welcome means for the value of their reserves to keep pace as a proportion of the total… As it is, whomever said that rising gold prices were antithetical to a central banker’s operational purview is simply woefully out of step with the modern era (i.e., these recent 10 years) of mark-to-market accounting of reserve assets. In this field, gold still has a very very long way to freely and comfortably run. You can count on it; the various international central banks surely are.

BTW, the following statement is incorrect.

"It came halfway through 1922 after a conference with U.S. investment banker J. P. Morgan produced no workable solution to Germany's problems."

J.P. Morgan wasn't alive in 1922.

BTW, the following statement is incorrect.

"It came halfway through 1922 after a conference with U.S. investment banker J. P. Morgan produced no workable solution to Germany's problems."

J.P. Morgan wasn't alive in 1922.

Hi Edwardo,

If you read the quote following that you'll see it was JP Morgan Jr, who died in 1943. But yup, I didn't put the Jr in just above it. Thanks, I'll fix that.

FOFOA

|> And trust me, most of you have no idea what I mean when I say Freegold. I can tell by the comments lately.

FOFOA, if I’m not mistaken – you see a quick and vast movement from paper to real things. You recently revealed an idea which continues to echo in my thoughts.

From FOFOA

But they are missing the significance of the bigger picture; that the credibility of the entire top of the pyramid is deflating. And it was this credibility that was holding all that sand up there in the first place.

But what I see is the beginning of a capital flow, in one particular (and significant) direction.

To me – Freegold is when the wealth invested in paper financial instruments realize that paper profits make not food, water, nor shelter, and subsequently ditch paper for real goods. This then causes a surge of settlements in dollars in the futures markets (some by choice, some by counter-party default) which then flow to the bottom of your mirror of Exeter’s Pyramid. Perhaps Freegold is too specific for my interpretation – maybe Freerealthings? Gold being the capstone of the revaluation?

From FOFOA

Good Mike. You're getting close. Follow the trail. If there's less food, where did the rest of it go?

To those that hold physical gold?

Dollars are not real.

Real things held now have their value. Price in dollars will disappear.

Benefit to be made twice.

Once in conversion to dollars above their value.

Twice in absorpsion of wealth in gold.

Opportunity cost of holding wealth outside gold?

Hello Jenn,

You and Mike each get partial credit. Here are my answers to the questions I asked. You've got to go back to the original questions and Desperado's post that prompted them to understand. And I did drop a couple hints. ;)

The original questions were:

Question: Desperado, what's the difference between "inflation protected food stamps" and $10,000 FRN's if an apple costs $10,000?

Answer: The stamps MIGHT get you an apple. The $10,000 FRN will get you an apple.

Alternate question: What do "inflation protected food stamps" and price controls have in common during a currency collapse?

Answer: They propel goods and services into the black market where hyperinflation actually unfolds.

These questions were in response to Desperado's comment where he said:

"Under the current regime, I think they will use inflation protected food stamps as the means to keep the sheeple fed, and they will work with large grocery chains to get food delivered. Unfortunately, those who currently don't need food stamps and in the future will, will have the same problem as all those with edollar assets trying to get through the door at once. So the middleclass will rush to get into the same system that the poor already inhabit."

In a post yesterday, Karl Denninger wrote:

"...you will be THROWING your gold at people to defend yourself."

I read Desperado similar to Karl, in that the middle class would be THROWING its gold into the streets while the poor eat like kings on the government dole. Only in this case, it would be dollars thrown in disgust, not gold. The people with dollars would starve while the stores are happy taking in government food stamps.

Well, if the food stamps are worth more than cash, then the government must be backing them with something worth more than cash. And that could only be BIGGER cash.

It will be a dynamically unstable environment, but it's not too hard to see the final outcome.

Hyperinflation will be too quick for the developments many of the commenters are describing. Goods will still be in the system, but they will go where they get the best price.

An apple for $10,000 sounds REALLY expensive. But it's not expensive at all if you realize that same apple also costs an orange. Goods will seek either other goods or cash in amounts that will compensate for the disdain of currency. Government can print all the inflation protected food stamps it wants. But if it is not backing those with $10,000 FRN's the food will go into the black market.

Continued...

And by "black market" I don't mean Walmart by candlelight. It will be chaotic and unpredictable.

And this is what will force physical cash hyperinflation. Government workers will only be able to get their families' apples where they spend $10,000 FRN's. Not in the "government cheese" breadlines. You think they'll show up for work for food stamps?

The only way the G can even ATTEMPT some of the scenarios in recent comments is to print FRN's like crazy to pay its stooges and to buy what it needs from the black market.

And as for Freegold, you don't understand it until you understand WHY it will be encouraged, incentivized and demanded by TPTB. This is where most people's perception breaks down. They can't see beyond the dollar reserve system.

Today the dollar is the global reserve currency. That means everyone holds dollars which are the lubrication of the wheels of global trade. This is what really matters to TPTB.

When the dollar no longer functions in this role, there will be but two options of what to hold in reserve. Gold, benefiting your own nation and not benefiting any other nation, or your trading partner's currency, the euro or the yuan. To understand this, you must look at what ARE international reserves? What are their function? And why are they important?

International reserves are not only the reserves held by your CB. They are all reserves (foreign currency holdings and gold) within your zone. The greater the reserves in your zone, the greater the ability to run a deficit. The lower the reserves in your zone, the greater the necessity to run a surplus.

Politicians are great at driving the economy toward deficit. But they struggle with encouraging a surplus. So, unless they can PRINT the global reserve currency, they rely heavily on the gross international reserves within their zone.

And once again, international reserves are either foreign currency or gold. If you hold your trading partner's currency, you give to him the same privilege the world gave the US during the dollar standard, called an "exorbitant privilege" by France in the 60's. If you hold gold, you give no privilege to your trading partner but instead, you raise the relative strength of THE DOMESTIC CURRENCY YOU PRINT!

So, with the dollar no longer the global reserve currency, the printer of the dollar will get MORE BANG FOR HIS BUCK (so to speak) on the international currency exchange, the more gold the people in his zone hold.

This is one of the amazing and inevitable conclusions that come out of Freegold. And gold's tremendous value (by current standards) under this system will be BECAUSE IT IS NEEDED, DEMANDED, AND SUPPORTED by TPTB. They will not be fighting it. Believe it.

Once you understand what is behind what I am saying, then you will understand Freegold.

Sincerely,

FOFOA

I have a little experiment if anyone else would care to play along.

Assuming a hyperinflation hits the US in the next couple of years, what can everyone agree on would be certain, or at lease highly likely, to occur. Here is my short list:

- The federal government will use the crisis to try to seize more power

- Industrial and agricultural production will collapse

- Many companies will not be able to adapt and will go bankrupt

- Trade partners including oil producers will refuse to accept dollars

- Tax revenue in inflation adjusted terms will collapse

- "Hoarders" will be blamed for "shortages"

- The government will try rationing

- There will be gasoline rationing and long queues

- Most of the middle class will be left destitute, as will the lower class

- The receiving inflation adjusted entitlements or salaries will do well at first, then they too will be overwhelmed

@Desperado

I agree with most of your short list, with one exception.

If you are in power when;

-production collapses

-power supplies fail

-the economy implodes

-hungry people take to the streets

I don't think you try and gain more political power. I think you try and fade quietly into the background, or seek asylum in an allied country.

That's usually what happens if you look back through history. Figures do rise to gain political power, but they're invariably new faces espousing change (true change) and demonising the old guard.

Hopefully it won't happen, and if it does, hopefully we'll get Ghandi and not Stalin. (yeah right)

|> And trust me, most of you have no idea what I mean when I say Freegold. I can tell by the comments lately.

FOFOA, if I’m not mistaken – you see a quick and vast movement from paper to real things. You recently revealed an idea which continues to echo in my thoughts.

From FOFOA

But they are missing the significance of the bigger picture; that the credibility of the entire top of the pyramid is deflating. And it was this credibility that was holding all that sand up there in the first place.

But what I see is the beginning of a capital flow, in one particular (and significant) direction.

To me – Freegold is when the wealth invested in paper financial instruments realize that paper profits make not food, water, nor shelter, and subsequently ditch paper for real goods. This then causes a surge of settlements in dollars in the futures markets (some by choice, some by counter-party default) which then flow to the bottom of your mirror of Exeter’s Pyramid. Perhaps Freegold is too specific for my interpretation – maybe Freerealthings? Gold being the capstone of the revaluation?

From FOFOA

Good Mike. You're getting close. Follow the trail. If there's less food, where did the rest of it go?

To those that hold physical gold?

Fofoa,

I read and understand (at least most of it) what you have posted. But, I believe the barrier to freegold is exactly the

issue that has allowed the true price of gold to be hidden, PEOPLE DON'T WANT TO TAKE PHYSICAL POSESSION OF THEIR GOLD! If

I look back at your video from a few lessons ago (I can't remember the title right now) but it was how fractional gold holders were able to sell more gold than they actually had by selling receipts. How was this possible in the first place? It was possible because people willingly surrendered their gold over to an entity that they precived as "safe" repository. They didn't feel safe holding their gold in their homes. The same issue exists today and until this paradigm shifts, free gold will never be realized and the true price of gold will continue to be hidden. So what is the catalyst that causes this paradigm shift of thinking? Is it possible that it might never happen? I believe this should be considered.

Allen,

if i am not mistaken the general public (most who are in debt and dont have any wealth to preserve) will not need to be involved in this run, only the giants that need to reserve their capital is required. in fact they dont even need to buy anymore, they just need to stop the flow of it.

imo the general public is part of the commodity run for silver which is not the same as the one for gold, the no gamble asset in the minds of those who matter.

as for the catalyst of shift in thinking.

lots of reasons, a failed US bond auction or even in the Euro Zone which is happening now, people realizing you can't bankrupt a casino by playing their game and instead taking away their credits until all they can do is give you cash settlement. even a food commodity shortage can trigger it like wheat.

perhaps a 2nd huge dip in stocks would cause people to run to physical gold as their paper values go worthless. that can also cause the credibility inflation that FOFOA has mentioned from the savers bubble.

but with every passing day the flow for gold gets smaller and smaller and that itself can be the trigger everyone ignores. gold not bidding for dollars anymore in huge amounts.

to me the only people who care about this are the people who have past and future(real things that the world needs) to protect.

to me the only people who care about this are the people who have past and future(real things that the world needs) labor to protect.

Did everyone catch George Ure's writing today?

he makes some very good points

scroll down to this part

Coping: You Say You Want a Revolution?

Several readers took me to task for recommending president Obama consider either Joseph Stiglitz or Paul Krugman to head up the National Economic Committee ....

http://urbansurvival.com/week.htm

A question about paper vs physical gold.

You've talked about how gold futures contracts won't be any good because they won't get delivery. I can see how that would happen. Then there are etf's where we don't really know how much gold they have, like gld, as i understand it. But they do have gold. Do you think they'll negate ownership priviledges or something?

Then there is a couple of closed end gold mutual funds, one being PHYS, that hold gold that is supposedly deliverable to the owners. If these funds own the physical gold, are you suggesting that someone will simply steal it from the owners of the funds? Like maybe the US gov't?

Do you think the only gold that counts is the gold you have buried in your back yard?

I've tried to post twice and it seems neither post has made it through. FOFOA, I know you were having issues with Blogger's spam filters -- did you see either of my attempts?

Hello Jenn,

Yes, all your attempts posted. None went in the spam filter. I even answered your comment. Most likely you need to click on "newest" at the bottom. When the comment count passes 200 it starts a new page. And if you don't realize it, then it just looks like nothing is posting.

Sincerely,

FOFOA

FOFOA, the irony is that Jenn probably won't see your response ;)

Perhaps you can edit the second last comment on the first page (mine) and say something in there? Doesn't bother me any, my post had no real content.

@ fofoa

"When a government tries to control an object (think: controlled substance) it sends it into a black market. It loses the control it was seeking. And when that object is the very engine of that government's power (think: physical dollars), it loses that control as well. At that point it must go to the black market to find what it needs. And it will have to pay that black market in the terms of its (the black market's) choosing. You can arrest a man, but you can't arrest a market.

Whether markets are free from government or not (a relativistic question), market forces are always present. Government domination cannot outlaw market forces.

I think you are all giving the US government far too much credit considering it is about to lose its golden goose. To me, you are all thinking like deflationists. You are describing the present situation of the federal government and projecting its present abilities into a future without the dollar. A ludicrous projection!

Soldiers don't fight without a paycheck that at least buys an apple. Even the stooges won't show up for work. And I'm talking about buying an apple at the market where apples are actually being sold. Not the government bread-lines for those with inflation protected food stamps, where you can "afford" all the food your family needs except that there's not enough to go around.

What you think of as the big domineering federal government is nothing without public confidence in its currency, the physical dollar. And confidence is one thing it CANNOT force. Confidence is the ONE thing that must be earned. The entire federal government operation from Pelosi to Private Benjamin will stop on a dime the minute it can't pay its stooges in inflation-adjusted terms.

Blocking (or "gating") electronic capital flight will be the least of its worries when the dollar goes. It'll be the outside world that'll be blocking the dollar at the exits, not the USG! How many zeros to add in the first batch of new bills will be the main question at that point. And the speed capability of the Fed's printing press will be the determining factor in answering that question.

Hyperinflation will be fast. Six months maybe. After that, Freegold. And trust me, most of you have no idea what I mean when I say Freegold. I can tell by the comments lately."

You can say that again. Oh, I guess you just did.

This should be a new post on it's own FOFOA!

Another big mental cog just dropped into place for me after reading this. Thanks again FOFOA.

Over three fourth's of the U.S.'s money supply takes the form of private credit (digits held within accounting databases), how well do you believe credit will hold up under the collapse in value of the dollar? Can banks (the administrators of digits) withstand a major devaluation? Wouldn't currency devaluation absent wage and credit inflation have the same effect as removing currency from the economy, as it did for Iceland? Speaking of Iceland, didn't all the credit amassed in checking and savings accounts go "POOF!" when their banks failed? If we're talking a mass exodus out of U.S. debt paper, do you think Citi, BoA, JPMC or GS et al will withstand the exodus? If over three fourths of the U.S.'s money supply went !POOF!", as it did in Iceland, how long do you think it will take the government to actually print currency to compensate? If the government is going to print us into hyperinflation, do you think they will bypass the debt mechanism of the Fed to do so? I mean, it would be silly of them to hyperinflate debt while trying to print themselves out of debt, don't you think?

Hello Carl,

When a currency devalues like Iceland the cost of everything rises. Yes, Iceland took it in the face, hard. It wasn't exactly the US federal government relative to the rest of the world. When a currency reaches the end of its timeline, like the dollar is, because of the collapse of an impossible debt load, either the banking system or the currency itself must take it in the face, hard. And in our case, it will be the currency first and foremost. The currency will be sacrificed to save the banks. But the banks (esp. Wall Street) will then follow the currency down in relevance.

Pure fiat currency has solved the problem of bank failures. Not that banks don't fail anymore, but that the savers don't lose their nominal savings like they did in the 1930's. In a healthy system those savings are credits from private banks holding fractional reserves from the central bank. In a dying system new central bank reserves are created to replace the private credits going "POOF". It is the reserves in the system that eventually hyperinflate, not the private credit.

One thing is clear and always has been. That the Fed and the US government will sacrifice the relative value of the dollar to keep the banking system and the federal government operational, even if only for a few more months. The alternative, from their perspective, is far worse.

But the important thing to recognize is that the initial devaluation, just like in Iceland, comes from external forces. That is, it is not a direct and proximate effect of their printing. Their printing that must follow this devaluation (to keep their essential parts functioning), is, on the other hand, a direct and proximate effect of the "external" (out of their control) devaluation.

Devaluation causes the price of everything to rise instantly, even the price of governing. This is the onset of hyperinflation. The printing to pay the rising price of governing is the effect, which then feeds back to the initial cause, creating a self-sustaining loop. Circulation velocity initiated by fear and panic (which can shift 180 degrees instantly) is the initial driver at the onset of hyperinflation. This does not require a large money supply.

As for bypassing the debt mechanism, no, I don't think they will. But I think it will be direct monetization between the Fed and Treasury, with no third parties involved. It will be done under an emergency mandate. And they won't be trying to print themselves out of debt, although that will come naturally as the debt will eventually be worthless. They will be printing to make sure the government stooges show up to work.

Sincerely,

FOFOA

FOFOA,

Carl chose an interesting example to support his deflation arguments. Iceland is probably the most extreme case study you could find.

Prices for imports hit hyper-inflationary levels overnight and a number of imported goods were apparently just not available fairly quickly. (So where does Iceland fit into a deflation scenario?)

When the Icelandic banks hit the wall their currency went "no bid" immediately according to Chuck Butler. Iceland's government didn't print money and compound the problem. No one wanted their currency, so what would be the point of cranking up the printing presses.

With such a small population (340,000 approx) they retained a high degree of social cohesion and limited scope for a crack up boom, Misean style hyper-inflation. They had to make do with things that were locally available. If necessary the population could have switched to barter very rapidly for these local goods.

Being a small isolated country with no land borders it was hard for the citizens to adopt another currency like the population of Zimbabwe. Although I imagine that the significant number of Icelanders working overseas would have provided some hard currency to relatives in Iceland.

The UK and Dutch governments bailed out the depositors from their countries. They printed the money and paid the bill respectively. In both cases the amounts were easily digested given the size of their economies.

There was also a geo-political element in the offer of emergency loans. Russia offered a multi-billion dollar loan with (according to some observers) their eye on a vacant naval base in Iceland that would have given them a year round forward base in the waters of northern Europe. Apparently this prospect was NOT viewed with equanimity in NATO or Washington.

In addition to these minor discrepancies between the USA and Iceland the Icelanders have weird sounding names and screechy female pop stars.

[quote]Prices for imports hit hyper-inflationary levels overnight and a number of imported goods were apparently just not available fairly quickly. (So where does Iceland fit into a deflation scenario?)[/quote]

Iceland fits nicely into a deflation scenario because rising prices alone, even if they happen overnight to the extent that occurred in Iceland, is not the whole argument; it takes money to make inflation. Iceland was punished for not having any by countries that did. Rising prices without the money to pursue them just makes you poorer, as it did for the Icelanders, and that’s not inflation, that’s deflation. Price is a moot point when you have no money to spend.

Here’s the lesson of Iceland that appears to be speed skated over; Credit Is Not Money, it is an I.O.U. Money. It’s worse than fiat in that you have nothing to show for it when it goes bad, such is the case of Iceland.

Just because we call credit 'money' or 'dollars' and we can spend it or save it, invest it or swap it, doesn't mean that it will act as if it were 'money' or 'dollars' in a crisis and history has clearly and repeatedly demonstrated that credit does not act as 'money' time and time again. I mean, why else would the FDIC be necessary if not to cover the credit that went "POOF!" in a bank failure? And that's the positive credit; the 'money' people believe they have in excess of debt.

So here we are discussing the fall of the dollar and nary a word about how this would affect the banking structure, the issuers of over three fourths of the U.S.’s ‘Money Supply’, which takes the form of digits held within accounting programs. And it’s not just the U.S. that will be affected, it will be the entire global banking structure because the world’s reserve currency isn’t going to go down alone, it's going to take all credit with it. And that, my friend, is Hyper-Deflation.

Let me rephrase something:

It’s worse than fiat in that you have nothing to show for it when it goes bad, such is the case of Iceland.

It should read:

It’s worse than fiat in that you have nothing to show for it when it goes bad except the debt that created it, such is the case of Iceland.

Here is what I'm talking about, it starts at about 2:13 :

http://www.youtube.com/watch?v=m_atOvrTtT8&feature=player_embedded

.

Hello Carl,

"Iceland fits nicely into a deflation scenario because rising prices alone, even if they happen overnight to the extent that occurred in Iceland, is not the whole argument; it takes money to make inflation."

It may take new money to make inflation, but not hyperinflation. You are missing the key point in these three articles. That "overnight price rise" is the onset of hyperinflation. The response of the government/printer either keeps it going or halts it. In Iceland's case, the printer didn't keeping it going for many reasons, none of which apply to the USG.

The credit money you see disappearing has absolutely NO BEARING WHATSOEVER on hyperinflation. Credit money ALWAYS vanishes during (or just prior to) a hyperinflation. The disappearance of credit money is part of the cause. Hyperinflation is all about base money. 100% base money. Base money velocity. Gov't response. The massive printing does not drive the hyperinflation, it CHASES it.

From Part 1:

"First of all I would like to clear up probably the most common misconception about hyperinflation. What most people believe is that massive printing of base money (new cash) leads to hyperinflation. No, it's the other way around. Hyperinflation leads to the massive printing of base money (new cash).

Hyperinflation, in most people minds, conjures images of trillion dollar Zimbabwe notes. But this image is simply the government's reflexive response to the onset of hyperinflation, which is actually the loss of confidence in the currency. First comes the loss of confidence (hyperinflation), then, and only then, comes the massive printing to keep the government and its obligations afloat."

As a deflationist, your next reply will probably be something about how the USG could never possibly replace all the disappearing credit money fast enough to sustain hyperinflation. But you are still missing the point. The printing CHASES the hyperinflation which is a fear-driven event. And the USG will most definitely respond differently than Iceland because of its own massive need for a constant flow of dollars.

Your thesis seems to be that global price levels are presently and efficiently somewhat properly balanced against a quantity of M3 (or credit money) dollars. Wrong. Prices are WAY suppressed relative to fiat money because of 30 years of Credibility Inflation (see my post). Your thesis seems to be that if 3/4 of the M3 (or M-whatever) disappears then prices must fall because there are suddenly less "dollars". Wrong. Iceland is a perfect example. Prices rose 300% in two weeks (or something close to that) without any new printing. This is the onset of a currency event. It stopped in the krona after a couple weeks but it will not stop in the dollar for, my guess is, 3 to 6 months.

Sincerely,

FOFOA

Think of it this way. Hyperinflation is a velocity-driven event, not a quantity-driven. Velocity is a function of fear and panic. The quantity of new base money chases and adds fuel to the velocity (fear of devaluation) but never quite catches it. Fiat value is falling faster than they can print. And then, the more they print, the faster it falls. They can never quite pay their obligations in full once it starts... the USG, that is.

You contradict your own arguments.

“It may take new money to make inflation, but not hyperinflation.”

“That "overnight price rise" is the onset of hyperinflation.”

“The response of the government/printer either keeps it going or halts it.”

“In Iceland's case, the printer didn't keeping it going.”

So it does indeed take new money injected into the economy to fuel hyperinflation.

If the government doesn’t print to compensate (CHASE prices) then there can be no hyperinflation, rising prices due to the collapse in value of the currency notwithstanding. This establishes the fact that hyperinflation is a monetary event not a pricing event.

Moving on...

"Credit money ALWAYS vanishes during (or just prior to) a hyperinflation. The disappearance of credit money is part of the cause. Hyperinflation is all about base money. 100% base money. Base money velocity.”

I agree with this declaration 100%, all credit goes "POOF!" and all debts become due and payable in base money. So, all we have to do is establish the actual base money supply as opposed to promises to pay, i.e. credit money or, we can dispense with the euphemisms and call it by its real nomenclature: Debt Obligations.

Now, if we actually read the Fed balance sheet, we note that the actual base money supply is $899.9 Billion printed Federal Reserve Notes in circulation, $382.6 Billion of which within the U.S. and that, everything above that is a promise to pay. This includes demand deposits, checking and savings accounts, money orders and Reserves held on deposit at the Fed, all of which are promises to pay in base money, debt obligations.

Also, when you look at the numbers, you will note that the Fed and the government haven’t really expanded the real money supply by any meaningful amounts. What they have been doing is expanding and expending credit, debt obligations. And the reason they can do this is because credit as money still works.

"Credit money ALWAYS vanishes during (or just prior to) a hyperinflation.”

It puzzles me that you fail to grasp the magnitude of the consequences involved in that statement because EVERYTHING we do is done via credit money. From unemployment pay and food stamps to multibillion-dollar deals that span the globe, from Wall Street to Main Street, all credit money. And please remember that Wall Street banks have their credit money tentacles intertwined in every economy around the globe as well.

"Credit money ALWAYS vanishes” = GLOBAL HYPER-DEFLATION = All Commerce, All Around The Globe, Comes To A Screeching Halt.

You contradict your own arguments.

“It may take new money to make inflation, but not hyperinflation.”

“That "overnight price rise" is the onset of hyperinflation.”

“The response of the government/printer either keeps it going or halts it.”

“In Iceland's case, the printer didn't keeping it going.”

So it does indeed take new money injected into the economy to fuel hyperinflation.

If the government doesn’t print to compensate (CHASE prices) then there can be no hyperinflation, rising prices due to the collapse in value of the currency notwithstanding. This establishes the fact that hyperinflation is a monetary event not a pricing event.

Moving on...

"Credit money ALWAYS vanishes during (or just prior to) a hyperinflation. The disappearance of credit money is part of the cause. Hyperinflation is all about base money. 100% base money. Base money velocity.”

I agree with this declaration 100%, all credit goes "POOF!" and all debts become due and payable in base money. So, all we have to do is establish the actual base money supply as opposed to promises to pay, i.e. credit money or, we can dispense with the euphemisms and call it by its real nomenclature: Debt Obligations.

Now, if we actually read the Fed balance sheet, we note that the actual base money supply is $899.9 Billion printed Federal Reserve Notes in circulation, $382.6 Billion of which within the U.S. and that, everything above that is a promise to pay. This includes demand deposits, checking and savings accounts, money orders and Reserves held on deposit at the Fed, all of which are promises to pay in base money, debt obligations.

Also, when you look at the numbers, you will note that the Fed and the government haven’t really expanded the real money supply by any meaningful amounts. What they have been doing is expanding and expending credit, debt obligations. And the reason they can do this is because credit as money still works.

continued.....

"Credit money ALWAYS vanishes during (or just prior to) a hyperinflation.”

It puzzles me that you fail to grasp the magnitude of the consequences involved in that statement because EVERYTHING we do is done via credit money. From unemployment pay and food stamps to multibillion-dollar deals that span the globe, from Wall Street to Main Street, all credit money. And please remember that Wall Street banks have their credit money tentacles intertwined in every economy around the globe as well.

"Credit money ALWAYS vanishes” = GLOBAL HYPER-DEFLATION = All Commerce, All Around The Globe, Comes To A Screeching Halt.

And that, almost became our reality in 2007/08, next time they’re not going to be able to stop it.

So, what velocity do you believe -$0.00 can achieve?

As for myself, I would guesstimate unlimited velocity.

Sorry about the redundancy, it kept telling me that my post was too long so I kept witling it down and posting chunks.

Thank you google.

Hello Carl,

Yes, blogger is a pain. I find that it is best to preview first, then post.

"Credit money ALWAYS vanishes during (or just prior to) a hyperinflation.”

It puzzles me that you fail to grasp the magnitude of the consequences involved in that statement because EVERYTHING we do is done via credit money."

Perhaps I actually understand the magnitude of these consequences better than any hyperinflationist you've ever encountered before now. I agree with most of what you describe. What puzzles me is how deflationists fail to grasp the consequences of the consequences in this political world of the modern dollar.

I'm just curious. Did you read all three of these posts or just part 3? I only ask because I addressed points in the first two that I feel compelled to make again now, which makes me think you probably only read part 3. Also, there was debate that followed in the comments of all three including participation by Mish, in case you didn't see it.

In part 1 I addressed the question, "What is a deflationist?" And I answered it with exactly what I see you doing now:

"What is a deflationist? It is one who looks very closely at the present structure of everything, the laws, the rules, the regulations, what is supposed to happen, who should fail, etc… but ignores the political (collective) will that backs it all up. The same political will that always changes the rules to suit its needs as surely as the sun rises. And it is this political will that makes dollar hyperinflation a certainty this time around."

The following quote from FOA is important because, simple as it is, it really states the crux of the dispute:

""My friend, debt is the very essence of fiat. As debt defaults, fiat is destroyed. This is where all these deflationists get their direction. Not seeing that hyperinflation is the process of saving debt at all costs, even buying it outright for cash. Deflation is impossible in today's dollar terms because policy will allow the printing of cash, if necessary, to cover every last bit of debt and dumping it on your front lawn! (smile) Worthless dollars, of course, but no deflation in dollar terms! (bigger smile)"

Now you have to understand a nuance in this statement. When he says, "saving debt at all costs" he's not talking about preserving the debtor's obligation to pay. He's talking about nominally saving the savers who have been lulled for decades into holding other people's debt obligations as their "money."

And, along this line of reasoning, I take issue with one point you made:

"...Reserves held on deposit at the Fed, all of which are promises to pay in base money, debt obligations."

Reserves held on deposit at the Fed are "Fed obligations" TO PRINT. Or, as you say, to pay in base money. But the Fed is the only bank that can print its obligations. Which makes them qualitatively different than all others. This also applies to official guarantees, like the new infinite FDIC, or the mega Pension Fund guarantees. They may not be circulating cash yet, but they are essentially obligations TO PRINT by the one entity THAT CAN!

Continued...

This process is already well underway. Not the process of making sure the debtor's obligations remain intact, but the process of ensuring that the dollar's financial system in aggregate delivers at face value nominally. This is what they can and will ensure. Nominal delivery to the savers (pensions, foreign reserve holders, etc...) Nominal delivery is all they can guarantee, is what is being guaranteed, and these guarantees are priming the event that will force the USG to force the Fed to print physical cash in higher denominations for its own survival.

Between my publishing Parts 1 and 2, someone else published an article about hyperinflation happening in digital (or electronic) currency, something I absolutely think is 100% impossible. So in part 2 I addressed the question of the transition to physical currency that will be part of the collapse of the dollar. Apologies for the long reprint, but it is the best way to point you to my reference:

"...at some point there is going to be a risk premium for accepting institutional promises of delivery of something physical (physical cash) in the future.

That HK bank knows it will have to cough up the cash today if it accepts the wire transfer, but it may not see the replacement cash for a week. Will that cash in a week be worth the same as the cash going out the door today? Probably. But if there's a chance that it won't, then there is a risk premium to be charged. This is one hidden little corner where that nasty hyperinflation bug may first appear.

Once the time factor begins to present a perceived risk to the institutional banking system, it's all over. The system will need a large infusion of physical cash. Each and every "digital currency unit" is a debt of a physical dollar, backed by a debt, backed by a debt, backed by a debt and so on. It is a very long chain. And like all chains, it is only as strong as its weakest link! And there are a lot of weak links out there. The FDIC says about 800 of them right now if you believe the FDIC.

When one of these weak links breaks, it will not be enough to simply feed the cash to that broken link. The time factor will come into play. The Fed will have to ship physical dollars to ALL the links in the broken chain at once to avoid a panic. This will require a large infusion of physical cash.

Luckily this is possible today! Cash is the reserve, and cash can be created at will!!

Back in the 30's, gold was the reserve, but gold could not be created at will. If it could have been, then they would have just closed the banks long enough to truck enough gold out to the banks. And it's not just the customers lining up outside the banks that forces this action. It’s the interbank settlement process and the interbank confidence that lubricates this process. And eventually it will also include the larger retailers, who operate with a huge degree of confidence in the bank clearing system.

Think about the amount of promises a large grocery chain takes in every day with the confidence that settlement will happen before it needs to pay its obligations. The whole economy is like this. Whether one realizes it or not, the whole economy is operating on the confidence of the ultimate delivery of physical cash in the clearing process.

How about a gas giant like Shell? Think of all the "digital money" promises it takes in with faith in the clearing system to clear all imbalances each night.

Continued...

"There will come a point very quickly after confidence is shaken by some event, that physical cash will start to carry a small premium over digital money. This will be the time factor rearing its ugly head. I know of one cigarette shop that advertises a "cash price" in the window! This store charges less if you pay cash! That's not because of the time factor, of course… yet! But at some point those signs will start showing up at more places.

Today most vendors will eat the 2% it costs them to accept digital money. But what about when that cost rises due to the time factor risk premium? If someone pays you in cash today, you can go to the grocery tonight and buy food with it. If someone pays you with plastic, it will take a couple days before Visa deposits 98% of that amount in your bank account. Will your bank have any physical dollars then? So that you can recoup the lost 2%+ by getting the better cash price at the grocery?

Once this time factor settles in it will spread very quickly. The cigarette seller will prefer cash and will give you a discount for it so that he can go quickly and get the cash discount from the grocer. The banks will need loads of physical cash at this point. And they already have some of what they will need, sitting in excess reserves at the Fed.

The First Mechanism for Extra Zeros

How much will the Fed have to print up, and how fast? Unfortunately, $1 trillion in $100 bills is still 10 billion physical notes. If the Fed tried to print that, all in hundreds, in one week, that would require a printing rate of 1 million notes per minute, or 17,000 per second, 24 hours a day for a week. In other words, it is impossible.

But there is a simple solution! It's been used many times before and thus has many precedents. The euro already has €200 and €500 notes, presently trading for $254 and $636 respectively against the dollar. So it wouldn't be a huge leap for the Fed to print $500 and $1,000 notes instead of $50's and $100's in an attempt to hold the banking system together. It's actually a no-brainer. It reduces the printing time by a factor of 10!

Now instead of 1 million per minute, it's only 100,000 per minute. Well, that might be tough too. So it'll probably take a couple weeks and even then be an insufficient amount.

There's another option as well. They've got all those new $100 bills already printed. They could release the new bills at 100:1 on the old bills. Most people don't see this as hyperinflationary. They think of it as "issuing a new currency." So what's the difference between the two? There is NO DIFFERENCE!

Issuing the new $100's at 100:1 would be the same as issuing a $10,000 note. Same exact thing. But you must realize, it's not the notes that are driving the collapse (hyperinflation), it's THE OTHER WAY AROUND.

The hyperinflation is driving the NEED for the notes! So simply issuing the new $100 at 100:1 would not be an instantaneous devaluation of the dollar against all goods and services. No, they are rising at their own rate, REQUIRING a $10,000 note! Whatever you could previously get for $100, like a banana, would still be $100 in old dollars (for a few minutes anyway) after the new currency is issued. Most people don't think about it this way.

They think of the issue of new currency as "solving the problem" or "stopping the collapse." They think it would cause an immediate 100:1 revaluation of all goods and services allowing the monetary authority "to get ahead of the hyperinflation" and stop it dead in its tracks. No, it doesn't work this way. Issuing a new currency is only a very temporary fix and worst of all, it feeds fuel to the fire.

Hyperinflation is very hard to stop once it starts. The only way you can stop it is by switching to a harder currency. But unfortunately for the dollar, this will not be a realistic option.

Continued...

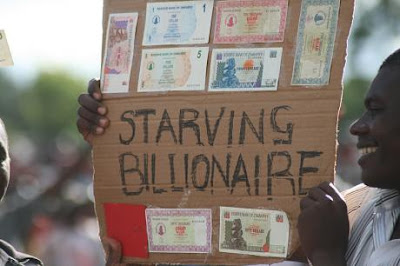

"If the dollar tries to peg itself to a new parity with gold (a new "emergency" gold standard) in the middle of the hyperinflation process, it will experience a run on any gold it puts up as backing. Imagine if Zimbabwe had tried to stop hyperinflation by opening a "gold window," selling gold at a fixed price in Zim dollars. (See image at the top!)

In Zimbabwe, they only stopped the hyperinflation by officially switching to a harder currency, the US dollar. But what currency could the dollar switch to? The euro? This is a possibility, but more likely the hyperinflation will simply run its course over a few months and by that point we'll ALL understand Freegold."

Then in the comments it was argued that the USG would resist or try to control this shift into physical currency. My counterargument is best summed up in this comment:

" When a government tries to control an object (think: controlled substance) it sends it into a black market. It loses the control it was seeking. And when that object is the very engine of that government's power (think: physical dollars), it loses that control as well. At that point it must go to the black market to find what it needs. And it will have to pay that black market in the terms of its (the black market's) choosing. You can arrest a man, but you can't arrest a market.

Whether markets are free from government or not (a relativistic question), market forces are always present. Government domination cannot outlaw market forces.

I think you are all giving the US government far too much credit considering it is about to lose its golden goose. To me, you are all thinking like deflationists. You are describing the present situation of the federal government and projecting its present abilities into a future without the dollar. A ludicrous projection!

Soldiers don't fight without a paycheck that at least buys an apple. Even the stooges won't show up for work. And I'm talking about buying an apple at the market where apples are actually being sold. Not the government bread-lines for those with inflation protected food stamps, where you can "afford" all the food your family needs except that there's not enough to go around.

What you think of as the big domineering federal government is nothing without public confidence in its currency, the physical dollar. And confidence is one thing it CANNOT force. Confidence is the ONE thing that must be earned. The entire federal government operation from Pelosi to Private Benjamin will stop on a dime the minute it can't pay its stooges in inflation-adjusted terms.

Blocking (or "gating") electronic capital flight will be the least of its worries when the dollar goes. It'll be the outside world that'll be blocking the dollar at the exits, not the USG! How many zeros to add in the first batch of new bills will be the main question at that point. And the speed capability of the Fed's printing press will be the determining factor in answering that question.

Hyperinflation will be fast. Six months maybe. After that, Freegold. And trust me, most of you have no idea what I mean when I say Freegold. I can tell by the comments lately."

Sincerely,

FOFOA

Hello Fofoa,

I am not sure if I should comment here or on the current thread, but here goes...

In Switzerland we use the EC card, which is really an ATM card, to make most purchases. These cards can even be pre-loaded with digital cash. Payments made with these cards are charged a flat fee of a about 30 cents, and are instantaneously deducted from a cash (checking) bank account. If the pre-loaded cash is used, there is no transaction fee. In large parts of Europe, bills are paid either online from a cash account or at the post office where cash can be used to settle the bill. My point is that these transactions occur at the speed of light, and correct me if I am wrong, but the cash appears instantaneously in the proper account of the vendor.

In the US, I believe debit cards function this way. And I believe that with credit cards used for on line purchases and purchases where the vendor has on online electronic credit card reader, the transaction is booked immediately.

Now I understand what you are saying about a time lag in clearing transactions for electronic bank transfers. But don't forget that there is also a time factor involved in cash, first that it has to be physically transported to the place of settlement where e-transactions can be done online.

So I think that for domestic transactions it is entirely feasible that at least through the beginning of hyperinflation that the current electronic money system functions intact. At later stages, all bets are off because as you say it will be come entirely political.

Finally, I have a question about international credit money holders. All these foreign entities holding various dollar denominated debt instruments are obviously at some point try to sell these and go through dollar cash accounts in order to change to instruments denominated in other currencies. If Bernanke is going to keep his interest rate curve flat, he will be forced to buy up a flood of treasuries and corporate bonds. He will not be sending 747 loads of paper dollars overseas to pay for this. How do see all this M1 money coming back to the US for settlement? Is it all just going to instantaneously go up in smoke?

Hi Carl,

I was tired when I read your comment about my observations on your choice of Iceland as an example of deflation. So I decided to sleep on it before responding. Having just re-read your comment I find I'm still confused by your thinking.

BTW I watched that video you linked and it explained nothing to me. The commentator presented a series of unsupported assertions as facts.

It would be helpful if you defined your terms. What are your definitions for the following terms?

1. Inflation

2. Deflation

3. Hyper-inflation

4. Hyper-deflation

5. Money

Without these definitions most of your first paragraph makes no sense to me. From your comment:

"Iceland fits nicely into a deflation scenario...."

Definition? Evidence?

"... because rising prices alone, even if they happen overnight to the extent that occurred in Iceland, is not the whole argument; it takes money to make inflation."

"Iceland was punished for not having any by countries that did."

This seems to imply some singular global money that Iceland was lacking.

"Rising prices without the money to pursue them just makes you poorer, as it did for the Icelanders, and that’s not inflation, that’s deflation."

The Icelanders had Icelandic krona before and after their currency crisis. They had enough to bid up prices in krona, on some goods, by 300%.

"Price is a moot point when you have no money to spend."

Can't argue with that last sentence Carl.

Cheers

Hello Desperado,

"My point is that these transactions occur at the speed of light, and correct me if I am wrong, but the cash appears instantaneously in the proper account of the vendor."

You are completely missing the point that electronic money, in ANY form, is simply a liability or obligation of one private institution to supply HARD currency to another. Hard currency being physical cash. What is transferred at the speed of light is the obligation, NOT the currency. NOTHING is cleared in electronic transactions (of any kind, prepaid or not). But in physical currency transactions, it is.

Sincerely,

FOFOA

But Fofoa,

You said: "electronic money, in ANY form, is simply a liability or obligation of one private institution to supply HARD currency to another. Hard currency being physical cash."

Isn't a paper dollar just a debt certificate anyway? If the government guarantees all liabilities of a bank (your private institution), isn't digital cash in your checking account at that bank as good as paper cash in your pocket, since they both would then represent the full promise and power of the federal government backing it?

I guess the question would be would ecash be as readily accepted as paper cash, and in the black market of course not. So I think you and I are really arguing about time frames.

I am convinced the feds early on will try rationing and population control to cling to power. Isn't this already what Obamacare and food stamps are about? This will entail trying to force the entire market of goods and services to use emoney. How long this will last I can't say, but large, organized black markets won't appear over night. Longer term the federal government will collapse as they run out of real money and the states and counties will simply ignore them. Somewhere between the these two interim phases, the Feds will lose control as black markets take over. How long each phase lasts I certainly can't say. But long before they allow bread and/or gasoline prices to rise above monthly salaries they will try rationing, and they will blame hoarders. Did you see this clip of Charles Munger calling gold hoarders "jerks"?

"if you're capable of understanding the world, then you have a moral obligation to become rational. I don't see how you become rational by hoarding gold. Even if it works you're a jerk"

@ Carl, FOFOA,

I hope that you two can continue the discussion. It does seem that you agree more than disagree, and clearing up definitions and assumptions (as Costata said) would bring your positions together. Or if not together, at least to where you can pinpoint where exactly you disagree.

For example, when Carl says "rising prices alone, even if they happen overnight to the extent that occurred in Iceland, is not the whole argument; it takes money to make inflation," then I get confused. To me, rising prices signal inflation. A 300% rise virtually overnight would be on the verge of hyperinflation, though not quite.

I understand the monetarist arguments that, strictly speaking, inflation is an increase in the money supply. But, as FOFOA said in his 'credibility inflation' post, if we go by that definition of inflation, then we have had inflation of the money supply over the past 30 years, but we haven't had the rising price (of goods, not of financial assets) effect to go with it. Well, the money has been created, and now we'll have our inflation.

I am not sure if my input is wanted or it if adds to the discussion much, but I thought i might help clarify some things.

It is my understanding that payments made electronically are only paid into the vendor's account once daily when settlement is made, usually some time before midnight and usually at a fixed time.

Once a month, the appropriate "fees" are deducted from the vendor's account calculated from the amount of, and/or percentage of each transaction. Not unlike a kickback or tribute. The difference between debit and credit money, for the vendor, is how the fees are calculated.

The only reason this is stomached, among many at least, is because it is expected and it would cost the vendor business if it wasn't offered.

If you were to add uncertainty of payment, then, well, they might insist on cash.

So it is already preffered today to recieve payment in cash. First, it is cheaper. Second, settlement is made on the spot.

For what it's worth, most people (the masses) do not view physical currency as a debt instrument, but as payment in full. Not only that, but it grants the vendor the ability to keep it out of the system, or hidden from the watchful eyes of some.

@Gilligan,

I am not certain whether you were discussing debit cards or credit cards, you just discuss electronic payments.

When you drive to a gas station to pay for your tank using a debit card, it displays the amount, verifies your card, and then checks if you are authorized for the amount of the transaction. In Switzerland the central clearing bank Payserv (owned jointly be the Swiss banks) clears the transaction. Your next purchase on that day will be validated against your account balance minus what you just spent. Of this I am sure. How the debit card clearing in the US works I do not know. Perhaps in the US the transaction is sent around in batch files to be run on various systems during the night. It is an important weak point that would prevent a smooth transition to emoney. In any case I am sure that these are the kinds of gaps that our fearless leaders are quickly trying to close in their finance committee's.

True what you say about what people accept as "payment in full". I recently bought a car, payment in full was when the money showed up in his online account, this would be overnight. But I think a tank of gas works differently.

Desperado,

I have to agree with Gilligan. Although this statement is true:

"Your next purchase on that day will be validated against your account balance minus what you just spent."

The card transaction is clearly not the same as payment in physical currency if the spending power isn't immediately transferred to the vendor.

The cardholder's bank has merely reserved a portion of their client's account balance pending settlement of the payment instruction.

If a vendor fears that they will not receive the same purchasing power when settlement occurs then a rational businessman will seek cash settlement at the time of purchase.

Extending this thought further, if a cardholder cannot "pay by card" they will go to their bank and seek cash.

How many days supply of cash are banks required to hold? In Australia it's five (5) days. Not much of a buffer in a crisis of confidence in the payment system.

Oh come on. You are citing Gideon Gono in defense of your position? As if he would ever admit responsibility for causing hyperinflation. The monetary authorities in Germany blamed everyone but themselves too, you know.

Citing this guy to defend your arguments shows that you are a crank.

"Credit money ALWAYS vanishes during (or just prior to) a hyperinflation.”

It puzzles me that you fail to grasp the magnitude of the consequences involved in that statement because EVERYTHING we do is done via credit money."

”Perhaps I actually understand the magnitude of these consequences better than any hyperinflationists you've ever encountered before now. I agree with most of what you describe. What puzzles me is how deflationists fail to grasp the consequences of the consequences in this political world of the modern dollar.”

And I wonder if hyperinflationists have any concept of time.

Yes, the government is going to respond by printing, while in the interim (intervening time), the people will be fully involved in their own response to having their economy collapse from underneath them. What odds would you give on the government and the Fed surviving their response?

I thank you for agreeing with most of what I discribe.

Quite frankly, your arguments are logically inconsistent and very frustrating to deal with.

As an example, you go from venders giving discounts for cash over credit in normal commerce to the Fed printing $500 and $1,000 denominated notes in response to the higher demand for cash. Why????

If people need $1s, $5s, $10s, $20s, $50s and $100s to gain the cash discounts offered over credit, why would the Fed respond with $500 and $1,000 notes?? The majority of people don’t earn $500 a week, how will printing $500 dollar notes help them? Is this your notion of hyperinflation, wages and prices chasing higher denominated notes?